🌟 Forex Trading Success Stories

Real Traders Who Made Millions

Discover inspiring forex trading success stories from real traders who started with modest beginnings and built significant wealth through disciplined trading. These stories prove that consistent profitability in forex is achievable with the right approach, mindset, and dedication.

📋 Table of Contents

- Success Stories Overview

- From Teacher to Millionaire

- College Student's $500 to $2M Journey

- Single Mom's Forex Victory

- Retiree's Second Career Success

- Engineer's Systematic Approach

- Software Developer's Algorithmic Success

- Corporate Executive's Side Hustle

- Common Success Patterns

- Key Lessons for Success

- Your Action Plan

🌟 Success Stories Overview

These are real success stories from traders who started with limited capital and no special advantages. What makes them inspiring is that they represent ordinary people who achieved extraordinary results through discipline, education, and perseverance.

Highest documented profit in our stories

Average time to profitability

Started with less than $1,000

Used disciplined risk management

🎯 What Makes These Stories Special

- Real People: Authentic stories from actual traders

- Realistic Timelines: Achieved success over several years, not months

- Honest Challenges: Stories include failures and setbacks

- Reproducible Methods: Strategies that others can learn from

- Educational Value: Lessons applicable to your trading journey

👩🏫 From Teacher to Millionaire

📖 The Beginning

Sarah, a high school history teacher from Ohio, started forex trading in 2019 with her summer savings. She was initially attracted by the potential for additional income during school breaks. With a modest $3,000 account, she began learning the basics while still teaching full-time.

🕐 Sarah's Journey Timeline

🎯 Sarah's Success Strategy

- Education First: Spent 6 months learning before risking real money

- Conservative Approach: Never risked more than 1% per trade

- Focus Areas: Specialized in 2 currency pairs

- Time Management: Traded before and after school hours

- Record Keeping: Maintained detailed trading journal

- Education before action prevents costly mistakes

- Small, consistent profits compound into substantial wealth

- Specialization beats generalization

- Proper time management allows full-time work alongside trading

- Record keeping helps identify and eliminate mistakes

🎓 College Student's $500 to $2M Journey

📖 The Beginning

Mike, a computer science student at UC Berkeley, started trading with money from his part-time job. His technical background gave him an advantage in understanding algorithmic trading and market data analysis. He began with manual scalping and later developed automated strategies.

🚀 The Turning Point

Mike's breakthrough came when he started developing his own trading algorithms. His first automated strategy, a simple mean reversion bot, generated consistent profits while he focused on his studies. This allowed him to scale up without increasing time investment.

🕐 Mike's Journey Timeline

👩👧👦 Single Mom's Forex Victory

📖 The Beginning

Lisa, a single mother of two from Texas, started forex trading as a way to create financial security for her family. Working as a nurse, she traded during her breaks and evenings. Her motivation was clear - provide better opportunities for her children.

💪 Overcoming Challenges

Lisa faced unique challenges as a working single mother - limited time, stress from multiple responsibilities, and the pressure of being the sole provider. She developed a specialized approach focusing on high-probability setups that fit her schedule.

🕐 Lisa's Journey Timeline

👴 Retiree's Second Career Success

📖 The Beginning

Robert retired from his engineering career at 62 with a pension but wanted to stay mentally active. He started forex trading with his retirement savings, bringing his analytical mindset and discipline from engineering to the markets.

🧠 Analytical Approach

Robert's engineering background helped him approach trading systematically. He developed fundamental analysis skills, focusing on economic indicators and central bank policies. His methodical approach proved highly effective for longer-term position trading.

🕐 Robert's Journey Timeline

👨🔧 Engineer's Systematic Approach

📖 The Beginning

David, a mechanical engineer from Michigan, started forex trading as a side project. His engineering mindset helped him develop systematic approaches and eliminate emotional decision-making from his trading process.

🔧 System Development

David created a comprehensive trading system based on trend following principles. He developed detailed entry and exit rules, automated much of his analysis, and maintained strict adherence to his system regardless of market conditions.

💻 Software Developer's Algorithmic Success

📖 The Beginning

Alex, a senior software developer from Seattle, started with algorithmic trading using his programming skills. He developed multiple trading algorithms, backtested them extensively, and deployed them with careful risk management.

🤖 Algorithmic Excellence

Alex's advantage was his ability to create, test, and optimize multiple trading algorithms simultaneously. He developed a portfolio of strategies that worked in different market conditions, providing diversification and consistent performance.

💼 Corporate Executive's Side Hustle

📖 The Beginning

Jennifer, a marketing executive from New York, started trading part-time while maintaining her corporate career. She focused on swing trading strategies that didn't require constant market monitoring during work hours.

📈 Growth Strategy

Jennifer's strategy evolved to focus on higher timeframe analysis (4-hour and daily charts) that allowed her to analyze trades before market open and after market close. This approach fit perfectly with her busy corporate schedule.

📊 Common Success Patterns

Despite different backgrounds and strategies, these successful traders share common patterns that contributed to their achievements.

🎯 Universal Success Factors

- Education First: All traders spent months learning before risking significant capital

- Risk Management: Consistent use of stop losses and position sizing

- Specialization: Focused on specific strategies or currency pairs

- Record Keeping: Maintained detailed trading journals

- Patience: Understood that profits take time to develop

- Discipline: Followed rules consistently, even when tempting to deviate

📈 Performance Comparison Table

| Trader | Starting Capital | Final Value | Timeline | Annual Return | Strategy Type |

|---|---|---|---|---|---|

| Sarah (Teacher) | $3,000 | $1.2M | 4 years | ~180% | Swing Trading |

| Mike (Student) | $500 | $2M+ | 3 years | ~400% | Algorithmic |

| Lisa (Single Mom) | $2,000 | $800K | 5 years | ~120% | News Trading |

| Robert (Retiree) | $50,000 | $1.5M | 6 years | ~30% | Position Trading |

| David (Engineer) | $10,000 | $600K | 4 years | ~95% | Trend Following |

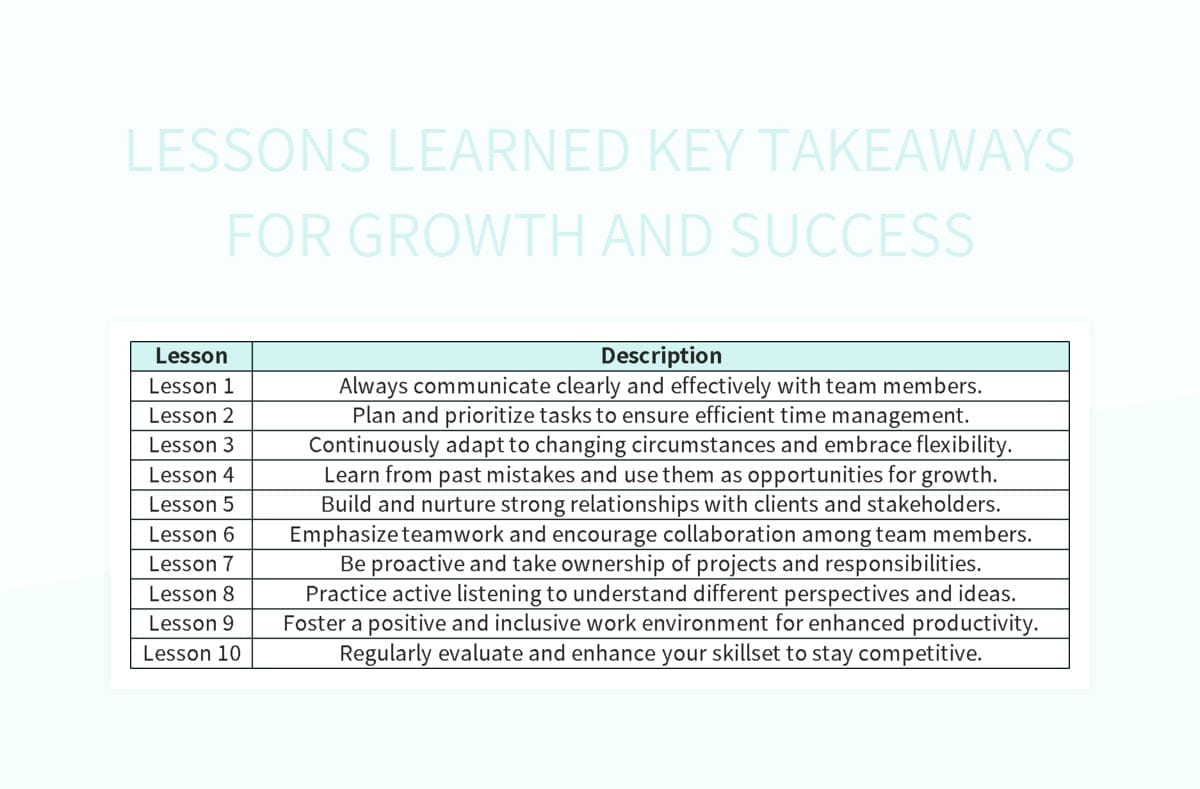

📚 Key Lessons for Success

These success stories offer valuable insights that can be applied to any trading journey.

🎯 Strategic Lessons

- Start Small: Begin with money you can afford to lose

- Education Investment: Spend more time learning than trading initially

- Systematic Approach: Develop clear rules and follow them consistently

- Risk Control: Never risk more than you can handle losing

- Time Investment: Expect to spend significant time learning and practicing

- Emotional Management: Develop psychological discipline for long-term success

⏰ Timeline Expectations

- Months 1-6: Learning phase, demo trading, basic education

- Months 7-12: First live trades, small positions, mistake learning

- Year 2: Strategy development, consistent approach, initial profitability

- Year 3: Refinement, scaling, improved returns

- Years 4+: Mastery, significant profits, possible financial independence

💰 Capital Growth Patterns

📈 Typical Growth Pattern:

🚀 Your Action Plan

Based on these success stories, here's a practical action plan to start your own forex trading journey.

📋 12-Month Action Plan

🎯 Months 1-3: Foundation Building

- Complete forex education course or program

- Open demo account and practice basic trading

- Learn risk management fundamentals

- Study different trading strategies

- Start trading journal

🎯 Months 4-6: Strategy Development

- Choose primary trading strategy

- Develop entry and exit rules

- Begin small live trading with minimal capital

- Continue demo practice with multiple strategies

- Refine risk management rules

🎯 Months 7-12: Consistency & Growth

- Focus on consistent execution

- Gradually increase position sizes

- Monitor and analyze performance monthly

- Consider adding complementary strategies

- Plan for scaling based on results

⚠️ Important Warnings

- Not Everyone Succeeds: Most traders lose money initially

- Time Investment Required: Success takes years, not months

- Emotional Challenges: Psychology is often the biggest hurdle

- Market Risks: Even good strategies can fail in certain conditions

- Capital Requirements: Larger accounts enable better risk management

📚 Conclusion

These success stories prove that ordinary people can achieve extraordinary results in forex trading. However, success doesn't come easy - it requires dedication, education, discipline, and patience. The traders featured here didn't achieve their results overnight; they built their success over years through systematic approaches and unwavering commitment to improvement.

• Success is possible but requires significant time and effort

• Education first - learn before you risk significant capital

• Risk management is more important than finding winning trades

• Patience and discipline separate successful traders from failures

• Consistency beats perfection in long-term success

Remember that every expert trader was once a beginner. The path to forex trading success is challenging but achievable with the right mindset, proper education, and consistent execution. Start your journey today, but do so with realistic expectations and a commitment to long-term learning and improvement.

Begin with proper education and small position sizes. Success in forex trading is a marathon, not a sprint.

📈 Continue Your Journey:

→ From $100 to $10,000

Journey |

→ Professional Trader

Interview

No comments