💰 From $100 to $10,000

Complete Account Growth Strategy Guide

This comprehensive guide will show you how to grow a small forex account from $100 to $10,000 using proven strategies, proper risk management, and realistic timelines. Learn the exact phases, techniques, and mindset needed for successful account growth.

📋 Table of Contents

- Setting Realistic Expectations

- The 5 Growth Phases

- Phase 1: Foundation ($100-$500)

- Phase 2: Learning ($500-$1,500)

- Phase 3: Growth ($1,500-$4,000)

- Phase 4: Acceleration ($4,000-$7,000)

- Phase 5: Scale ($7,000-$10,000)

- Advanced Risk Management

- Proven Growth Strategies

- Avoiding Growth Killers

- Timeline Planning

- Your Action Plan

📊 Setting Realistic Expectations

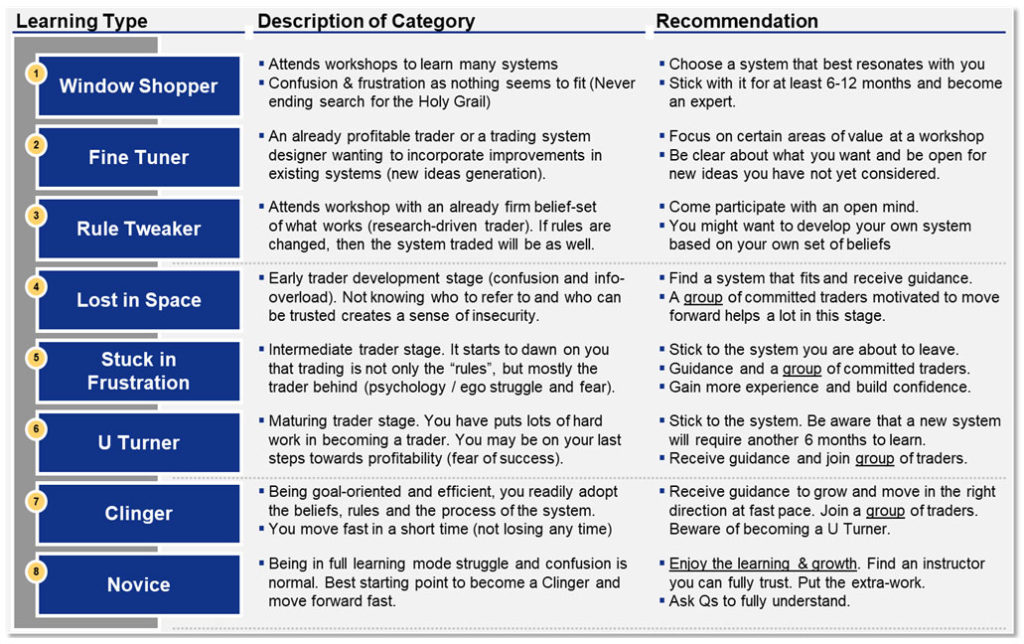

Growing a forex account from $100 to $10,000 is challenging but achievable with the right approach. Understanding the realistic timelines and challenges helps you prepare mentally and financially.

Realistic timeline for $100 to $10K growth

Average monthly returns needed

Win rate required for safety

Expected peak drawdown amount

🎯 Mathematical Reality

Growing a small account to $10,000 requires exceptional skill, discipline, and patience. Most traders fail at this goal. Only proceed if you're committed to the long-term journey and can handle significant losses along the way.

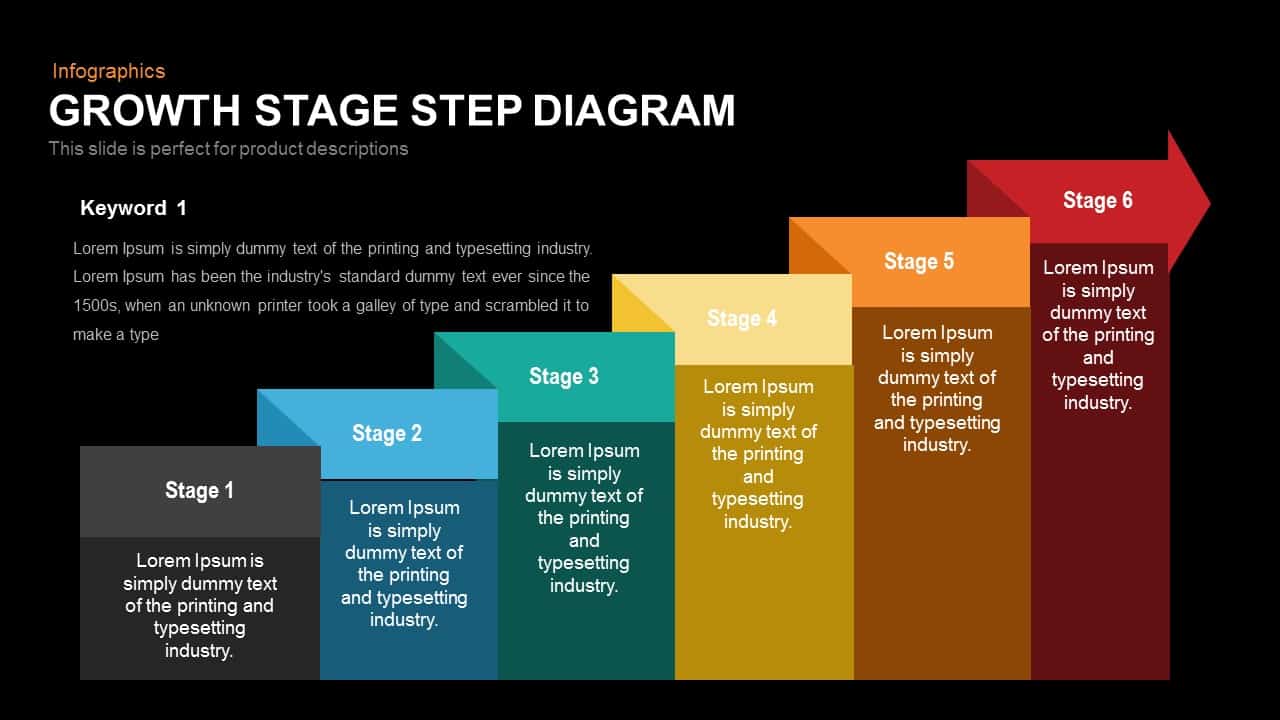

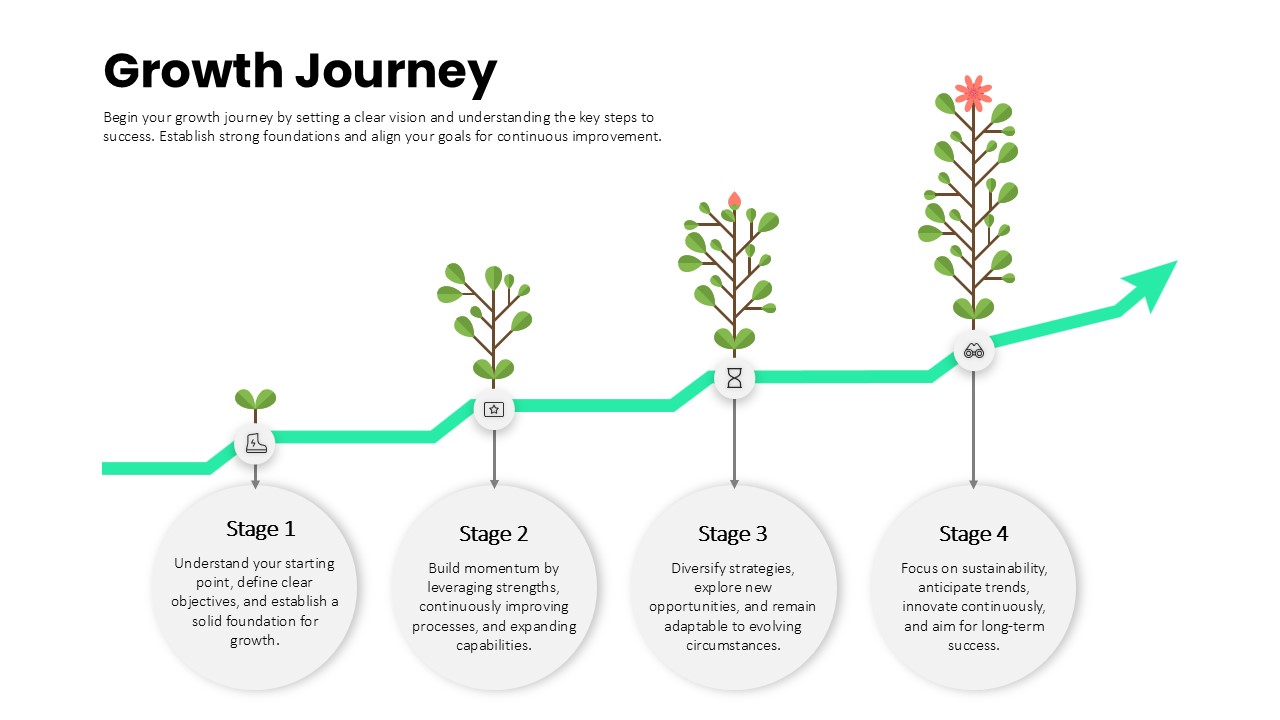

🎯 The 5 Growth Phases

Successful account growth follows distinct phases, each requiring different strategies, risk management, and mindsets.

- Phase 1: Foundation Building ($100-$500)

- Phase 2: Learning & Consistency ($500-$1,500)

- Phase 3: Steady Growth ($1,500-$4,000)

- Phase 4: Acceleration ($4,000-$7,000)

- Phase 5: Scaling & Optimization ($7,000-$10,000)

📈 Phase Comparison Table

| Phase | Account Range | Monthly Target | Risk per Trade | Primary Focus | Timeline |

|---|---|---|---|---|---|

| Phase 1 | $100-$500 | 20-30% | 2-3% | Education & survival | 3-6 months |

| Phase 2 | $500-$1,500 | 15-25% | 2-3% | Strategy refinement | 6-12 months |

| Phase 3 | $1,500-$4,000 | 12-20% | 2-3% | Consistent execution | 8-15 months |

| Phase 4 | $4,000-$7,000 | 10-15% | 1.5-2.5% | Risk optimization | 10-18 months |

| Phase 5 | $7,000-$10,000 | 8-12% | 1-2% | Capital preservation | 6-12 months |

🏗️ Phase 1: Foundation ($100-$500)

The foundation phase is about survival, education, and developing basic trading skills. This is where most traders fail, making it the most critical phase.

🎯 Primary Objectives

- Complete forex education and platform familiarization

- Develop basic risk management skills

- Find a trading strategy that works for you

- Surive the learning curve without losing all capital

- Build confidence through small successes

📊 Key Metrics

- Target Duration: 3-6 months

- Monthly Return Target: 20-30%

- Risk per Trade: 2-3% maximum

- Win Rate Goal: 60%+

- Maximum Drawdown: 30%

📈 Strategy for Phase 1

🎯 Recommended Approach

- Demo Trading First: Practice on demo for 1-2 months minimum

- Conservative Positions: Start with $0.01 lots on mini accounts

- Simple Strategies: Focus on clear, easy-to-execute setups

- Limited Pairs: Trade only EUR/USD and GBP/USD initially

- Risk Management: Strict 2-3% risk per trade maximum

⚠️ Common Phase 1 Mistakes

- Overleveraging: Using too much margin too early

- Strategy Hopping: Changing strategies frequently

- Emotional Trading: Revenge trading after losses

- Ignoring Risk Management: No stop losses or position sizing

- Unrealistic Expectations: Expecting quick profits

📚 Phase 2: Learning ($500-$1,500)

Phase 2 focuses on strategy refinement and building consistency. You should now have basic trading skills and be ready to develop a more systematic approach.

🎯 Primary Objectives

- Refine your trading strategy based on Phase 1 experience

- Develop consistent execution habits

- Improve win rate and risk-reward ratios

- Build confidence in your trading plan

- Start tracking detailed performance metrics

📊 Key Metrics

- Target Duration: 6-12 months

- Monthly Return Target: 15-25%

- Risk per Trade: 2-3%

- Win Rate Goal: 65%+

- Maximum Drawdown: 25%

📅 Phase 2 Milestones

📈 Phase 3: Growth ($1,500-$4,000)

Phase 3 is where your account should start growing more consistently. You've proven you can trade profitably, now focus on scaling up while maintaining risk management.

🎯 Primary Objectives

- Scale position sizes proportionally with account growth

- Maintain consistent monthly returns of 12-20%

- Develop advanced risk management techniques

- Consider adding complementary strategies

- Build psychological resilience for larger swings

📊 Key Metrics

- Target Duration: 8-15 months

- Monthly Return Target: 12-20%

- Risk per Trade: 2-3%

- Win Rate Goal: 70%+

- Maximum Drawdown: 20%

🚀 Scaling Strategies for Phase 3

⚙️ Advanced Techniques

- Proportional Scaling: Increase position sizes as account grows

- Compound Growth: Reinvest profits to accelerate growth

- Multiple Timeframes: Add higher timeframe analysis

- Currency Diversification: Include more pairs gradually

- Performance Analysis: Monthly strategy reviews and optimizations

⚡ Phase 4: Acceleration ($4,000-$7,000)

Phase 4 focuses on optimization and efficiency. Your account is now substantial enough to consider more advanced techniques and risk management strategies.

🎯 Primary Objectives

- Optimize your strategy for maximum efficiency

- Implement more sophisticated risk management

- Consider professional trading tools and analysis

- Develop systems for handling larger positions

- Prepare for the psychological challenges of Phase 5

📊 Key Metrics

- Target Duration: 10-18 months

- Monthly Return Target: 10-15%

- Risk per Trade: 1.5-2.5%

- Win Rate Goal: 75%+

- Maximum Drawdown: 15%

🏆 Phase 5: Scale ($7,000-$10,000)

Phase 5 is about reaching your goal while prioritizing capital preservation. The focus shifts from aggressive growth to sustainable profitability.

🎯 Primary Objectives

- Reach the $10,000 milestone safely

- Focus on capital preservation over aggressive growth

- Develop long-term sustainability plans

- Consider transitioning to professional trading

- Build systems for continued growth beyond $10,000

📊 Key Metrics

- Target Duration: 6-12 months

- Monthly Return Target: 8-12%

- Risk per Trade: 1-2%

- Win Rate Goal: 80%+

- Maximum Drawdown: 10%

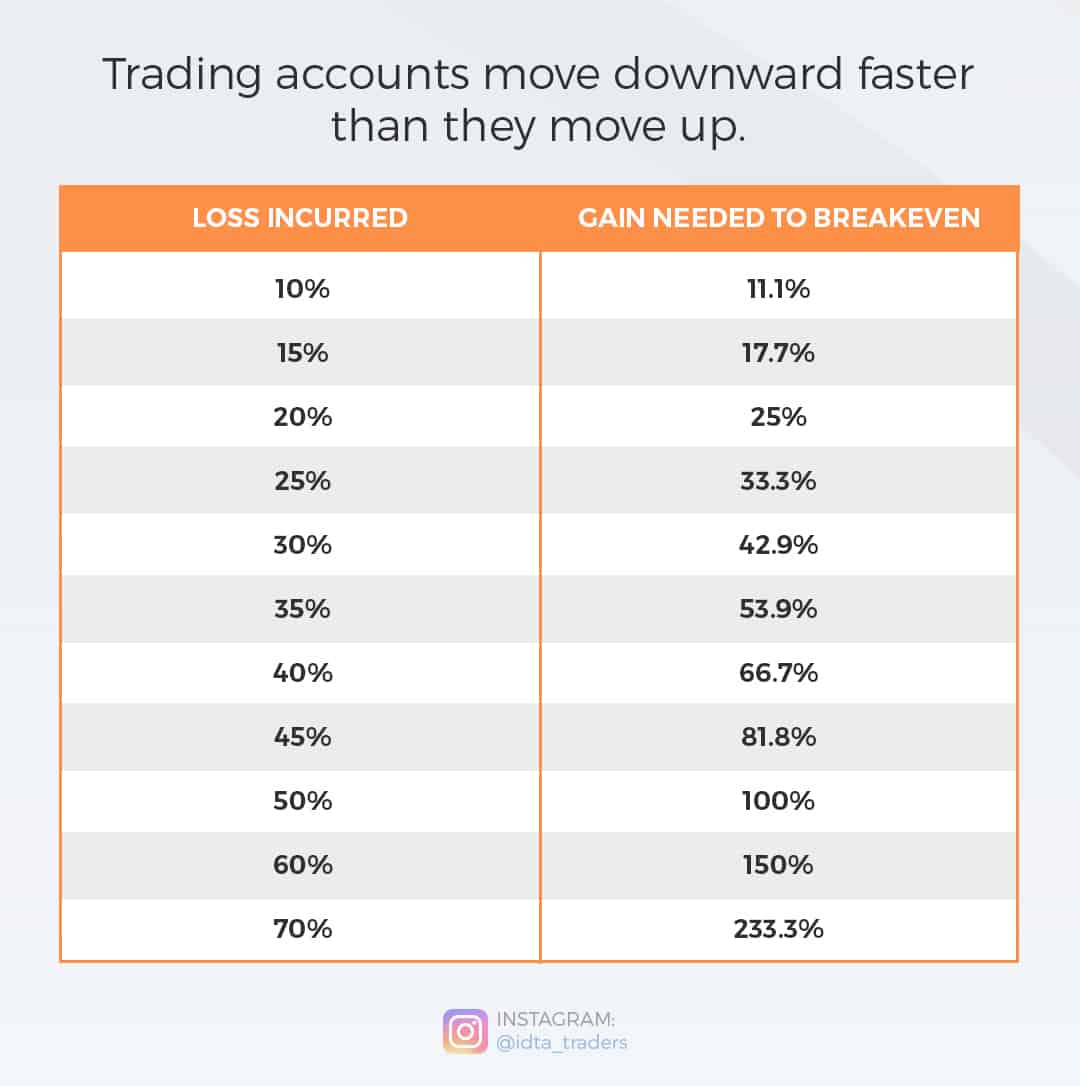

🛡️ Advanced Risk Management

As your account grows, your risk management approach must evolve. Advanced techniques help protect your growing capital while maintaining growth potential.

⚖️ Risk Management Evolution

| Phase | Risk Per Trade | Max Daily Loss | Max Weekly Loss | Max Monthly Loss | Recovery Strategy |

|---|---|---|---|---|---|

| Phase 1 | 2-3% | 6% | 12% | 30% | Reduce size, review strategy |

| Phase 2 | 2-3% | 5% | 10% | 25% | Temporary size reduction |

| Phase 3 | 2-3% | 4% | 8% | 20% | Strategy analysis required |

| Phase 4 | 1.5-2.5% | 3% | 6% | 15% | Immediate strategy review |

| Phase 5 | 1-2% | 2% | 4% | 10% | Trading halt until analysis |

🎯 Advanced Risk Techniques

📈 Professional Risk Management

- Kelly Criterion: Optimize position sizing based on win rate and payoff

- Portfolio Heat: Monitor total exposure across all positions

- Correlation Analysis: Avoid correlated positions

- Volatility Adjustment: Adjust position sizes based on market volatility

- Time-Based Risk: Reduce risk during uncertain market periods

🚀 Proven Growth Strategies

Different strategies work better at different phases. Understanding which approach to use when maximizes your growth potential.

📊 Strategy by Phase

- Phase 1-2: Simple scalping, clear breakouts, basic trend following

- Phase 3-4: Swing trading, multi-timeframe analysis, pattern recognition

- Phase 4-5: Advanced trend following, position trading, fundamental analysis

⚡ Growth Acceleration Techniques

- Compound Growth: Reinvest profits to accelerate compounding

- Seasonal Trading: Focus on historically profitable periods

- News Trading: Capitalize on high-volatility events

- Currency Carry: Take advantage of interest rate differentials

- Correlation Trading: Trade relationships between currency pairs

🚫 Avoiding Growth Killers

Understanding what destroys small accounts helps you avoid the most common pitfalls that prevent growth to $10,000.

- Overconfidence After Success: Increasing risk after good months

- Size Impatience: Trading positions too large for account size

- Strategy Abandonment: Changing systems when facing normal drawdowns

- Emotional Revenge Trading: Making larger trades to "win back" losses

- Underestimating Time: Expecting faster growth than realistic

🛡️ Protection Strategies

- Written Trading Plan: Follow rules regardless of emotions

- Regular Reviews: Monthly performance analysis and adjustments

- Size Discipline: Never increase risk beyond predetermined limits

- Psychological Preparation: Expect and plan for difficult periods

- Professional Mindset: Treat trading like a business, not gambling

📅 Timeline Planning

Realistic timeline planning helps you maintain motivation and avoid frustration during the challenging journey from $100 to $10,000.

📊 Expected Progression

⏰ Milestone Planning

🎯 Important Milestones

🎯 Your Action Plan

Based on this guide, here's your practical action plan to start growing your account from $100 to $10,000.

📋 First 30 Days

🚀 Week 1-2: Foundation

- Complete basic forex education course

- Open demo trading account

- Learn platform navigation and order execution

- Study basic technical analysis

- Read trading psychology materials

🚀 Week 3-4: Practice

- Start demo trading with $10,000 virtual money

- Practice simple strategies (breakouts, trend following)

- Implement risk management rules strictly

- Maintain detailed trading journal

- Analyze performance weekly

📈 Months 2-3: Live Trading Start

🎯 Initial Live Trading

- Open live micro account with $100-200

- Start with $0.01 lots maximum

- Trade only EUR/USD and GBP/USD

- Maintain 2-3% risk per trade maximum

- Focus on consistency over profits

⚠️ Critical Success Factors

- Never risk more than 3% per trade regardless of confidence

- Keep detailed records of all trades and performance

- Review performance monthly and adjust as needed

- Expect setbacks and plan for difficult periods

- Maintain realistic expectations about timeline and returns

📚 Conclusion

Growing a forex account from $100 to $10,000 is one of the most challenging goals in trading. It requires exceptional discipline, consistent execution, and the ability to handle significant psychological pressure. However, it's not impossible—with the right approach, realistic expectations, and unwavering commitment to risk management and continuous improvement.

• Timeline matters more than speed - consistent growth beats aggressive gambling

• Risk management is everything - protecting capital is more important than making profits

• Psychology determines success - emotional discipline separates winners from losers

• Education never stops - markets evolve, so must your knowledge

• Realistic expectations prevent failure - 4 years is more realistic than 1 year

Remember that the skills you develop in growing a small account will serve you for the rest of your trading career. Whether you reach the $10,000 goal or not, the discipline, risk management, and psychological skills you develop are invaluable.

Start with education and demo trading. Remember: every expert was once a beginner, but not every beginner becomes an expert.

📈 Continue Learning:

→ Professional Trader

Interview |

→ Forex Trading Mistakes

Recovery

No comments