Take Profit Strategies: Maximize Your Forex Profits Like a Professional Trader

While stop losses protect your capital, take profit strategies protect your profits. They're the difference between a good trade and a great trade, between breaking even and building wealth. Most traders focus entirely on entry signals and forget that how and when you exit winning trades determines your long-term profitability.

Understanding Take Profit Fundamentals

What is a Take Profit Order?

A take profit order is a predetermined price level where you automatically exit a winning trade to lock in profits. It's set when you enter the trade and should be based on technical analysis, not emotion or greed.

✅ Professional Take Profit Use

- Set profit targets based on analysis

- Use multiple profit-taking levels

- Lock in partial profits systematically

- Let some positions run for maximum gains

- Remove emotion from profit-taking decisions

❌ Amateur Profit-Taking Mistakes

- No take profit at all

- Taking profits too early out of fear

- Moving targets further away greedily

- Not taking any profits

- Emotional exit decisions

Why Take Profit Strategies Matter

- Profit Protection: Locks in gains before market reversals

- Risk-Reward Optimization: Ensures favorable risk-reward ratios

- Emotional Control: Removes greed and fear from decisions

- Account Growth: Consistent profit-taking builds wealth

- Strategy Consistency: Systematic approach to exits

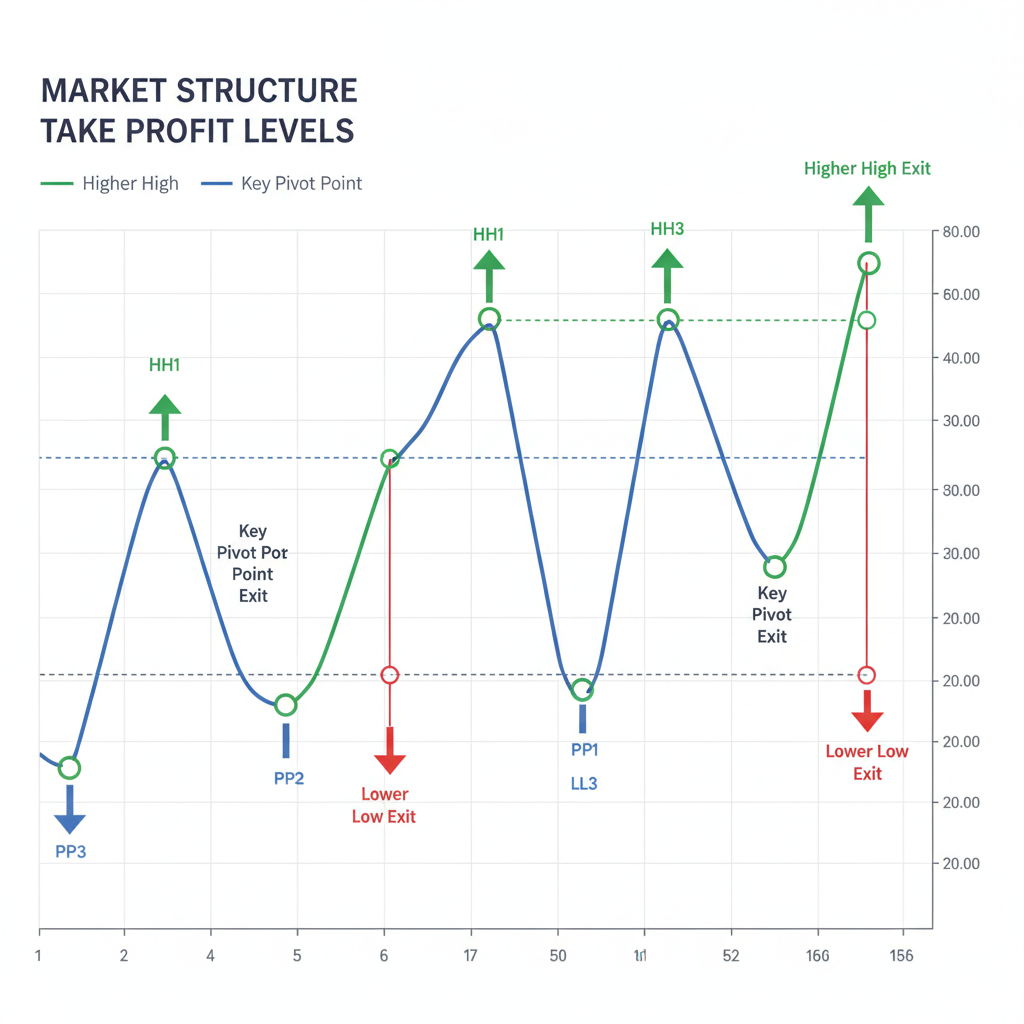

Technical Analysis-Based Profit Targets

📈 Chart-Based Take Profit Levels

Support and Resistance Targets

- Long Positions: Take profit near resistance levels

- Short Positions: Take profit near support levels

- Multiple Targets: Scale out at each major level

Target 1: 1.2550 (resistance, take 50%)

Target 2: 1.2600 (next resistance, take 50%)

Total Potential: 100 pips profit

Fibonacci Retracement Targets

- 38.2% Retracement: Conservative profit-taking

- 50% Retracement: Moderate profit-taking

- 61.8% Retracement: Aggressive profit-taking

- 127.2% Extension: Extension target

Entry: Long EUR/USD at 1.1000 after 100-pip swing up

TP 1 (38.2%): 1.1038, take 25%

TP 2 (50%): 1.1050, take 25%

TP 3 (61.8%): 1.1062, take 50%

Average TP: ~1.1050 level

Risk-Reward Ratio Based Targets

⚖️ Fixed Risk-Reward Ratios

Common Risk-Reward Ratios

| Risk:Reward | Win Rate Needed | Example Setup | Best For |

|---|---|---|---|

| 1:1 | 50%+ | 30 pip stop, 30 pip target | Scalping, news trading |

| 1:1.5 | 40%+ | 30 pip stop, 45 pip target | Day trading |

| 1:2 | 33%+ | 30 pip stop, 60 pip target | Swing trading |

| 1:3 | 25%+ | 30 pip stop, 90 pip target | Trend following |

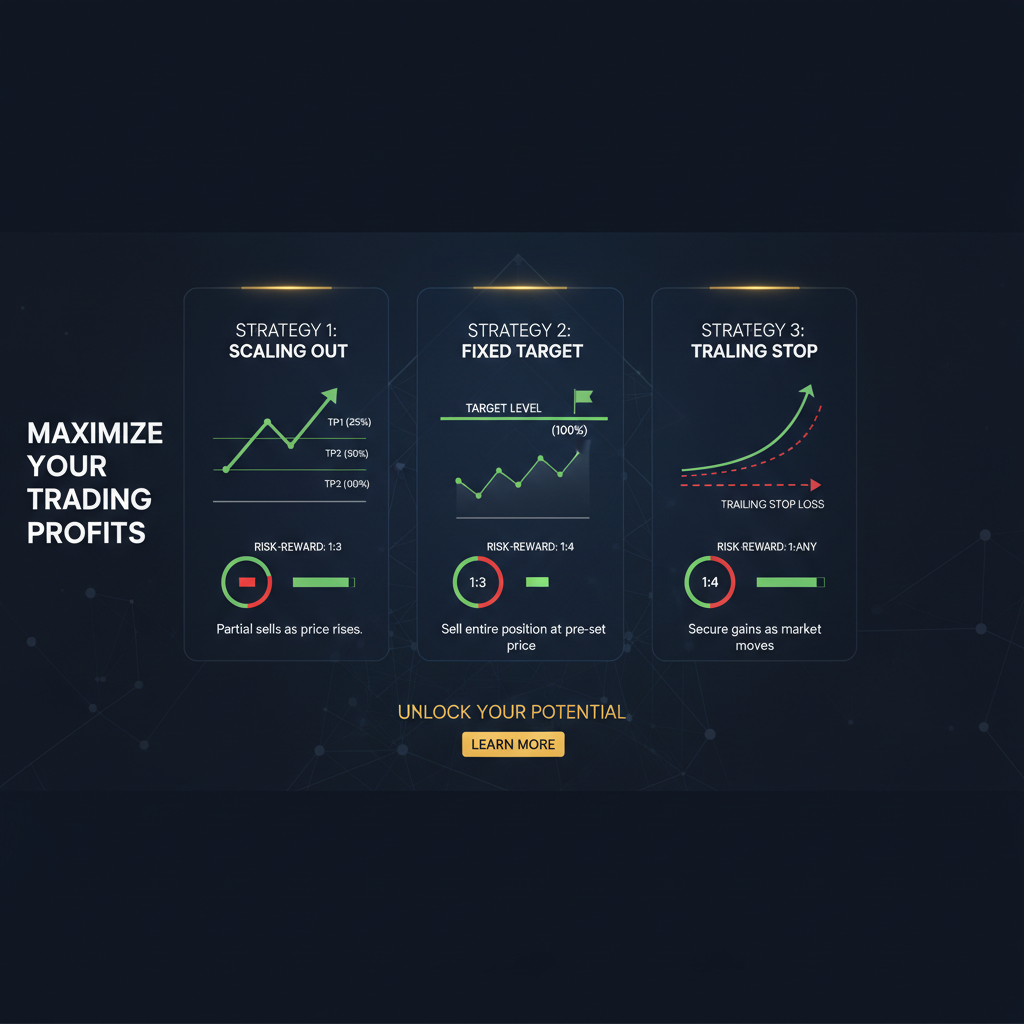

Scaling Out Strategies

Partial Position Exits

✂️ Scaling Out Implementation

Concept: Close portions of position at different profit levels.

Position: Long 1.0 lots EUR/USD at 1.1000

Target 1 (1.1025): Close 0.33 lots, lock in 25 pips

Target 2 (1.1050): Close 0.33 lots, lock in 50 pips

Target 3 (1.1075): Close 0.34 lots, lock in 75 pips

Result: Average profit per lot = 50 pips

Breakeven + Trailing Stop Method

⚖️ Risk-Free Trading Approach

Concept: Once trade moves into profit, move stop to breakeven and take partial profits.

Entry: Long EUR/USD 1.0 lots at 1.1000

Profit: Price reaches 1.1025 (+25 pips)

Action: Close 0.5 lots, move stop to 1.1000

Result: Locked in 12.5 pips profit, remaining 0.5 lots risk-free

Take Profit by Trading Style

Scalping Take Profit

⚡ Scalping Profit Strategy

- Profit Targets: 10-30 pips typical

- Method: Quick in-and-out, single target

- Timing: Exit immediately upon reaching target

Swing Trading Take Profit

📊 Swing Trading Profit Strategy

- Profit Targets: 100-300 pips typical

- Method: Multiple targets, scaling out

- Timing: Exit at major technical levels

Psychology of Taking Profits

😰 Fear-Based Exit Issues

- Fear of losing profits leads to early exits

- Panic selling on small reversals

- Not letting winners run enough

🧠 Professional Mindset

- Accepting that you'll never capture the entire move

- Focusing on consistent profits over home runs

- Understanding that taking profits protects your account

Creating Your Take Profit Strategy

🎯 Step-by-Step Take Profit Plan

Step 1: Define Your Trading Style

- Scalper: Tight targets (10-30 pips), quick exits

- Day Trader: Moderate targets (30-100 pips), session-based

- Swing Trader: Wide targets (100-300 pips), technical-based

- Position Trader: Very wide targets (300-1000+ pips), trend-based

Step 2: Choose Your Profit-Taking Method

- Single Target: Simple, fixed risk-reward ratio

- Multiple Targets: Scale out at different levels

- Breakeven + Trail: Lock in some, let some run

- Volatility-Based: ATR or market condition adjusted

Conclusion

Take profit strategies are the bridge between good trades and great results. Master these strategies and you'll join the small percentage of traders who consistently build wealth through systematic profit-taking.

No comments