Risk-Reward Ratio: The Foundation of Profitable Forex Trading

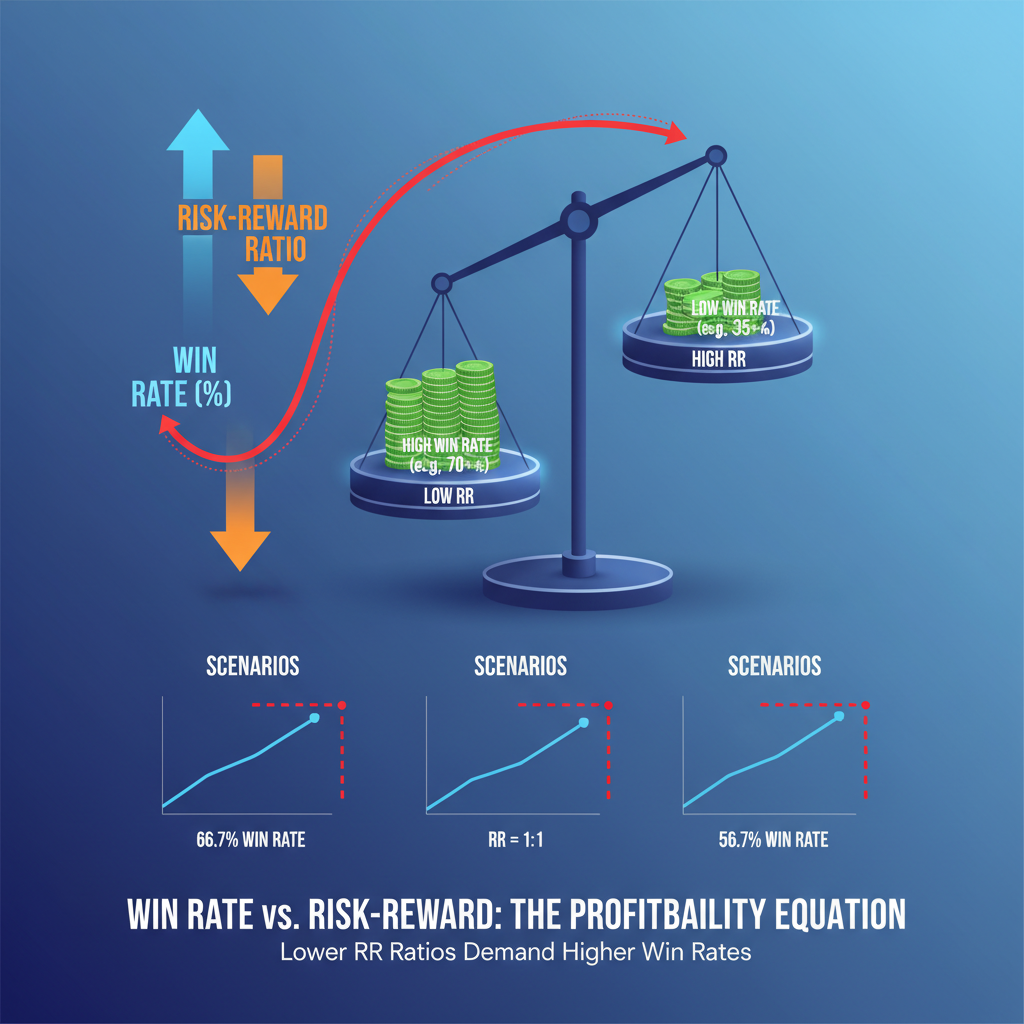

The risk-reward ratio is the mathematical foundation of profitable trading. It's what separates successful traders from those who lose money consistently. While most traders focus entirely on finding winning setups, the smart money knows that proper risk-reward ratios can turn even mediocre win rates into profitable accounts.

Understanding Risk-Reward Ratio Fundamentals

What is Risk-Reward Ratio?

The risk-reward ratio compares the potential loss of a trade to its potential gain. It's expressed as a fraction or ratio (e.g., 1:2 means you risk $1 to make $2).

📉 Risk (Stop Loss)

- The amount you're willing to lose

- Distance from entry to stop loss

- Fixed amount per trade

- Should be based on analysis

📈 Reward (Take Profit)

- The amount you aim to gain

- Distance from entry to take profit

- Can be flexible

- Should exceed the risk

Why Risk-Reward Ratios Matter

- Profitability Math: Lower win rates can still be profitable

- Account Growth: Favorable ratios accelerate wealth building

- Risk Management: Limits losses while maximizing gains

- Trading Discipline: Forces systematic approach

- Psychological Benefit: Reduces pressure to win every trade

Common Risk-Reward Ratios

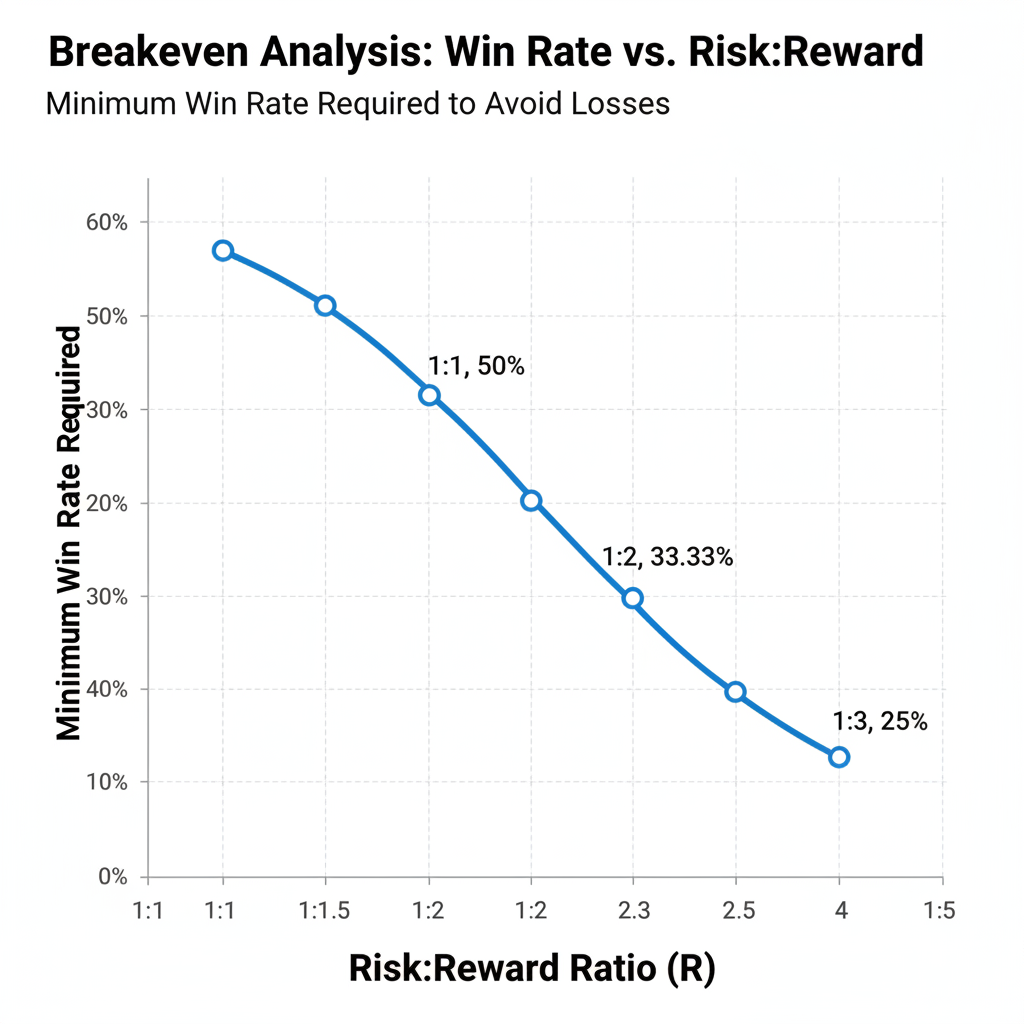

📊 Popular Risk-Reward Ratios

| Risk:Reward | Win Rate Needed | Example | Best For |

|---|---|---|---|

| 1:1 | 50%+ | 30 pip stop, 30 pip target | Scalping, news trading |

| 1:1.5 | 40%+ | 30 pip stop, 45 pip target | Day trading, quick moves |

| 1:2 | 33%+ | 30 pip stop, 60 pip target | Swing trading, beginners |

| 1:3 | 25%+ | 30 pip stop, 90 pip target | Trend following |

| 1:5 | 17%+ | 30 pip stop, 150 pip target | Position trading |

Calculating Risk-Reward Ratio

Basic Calculation Method

🔢 Risk-Reward Ratio Formula

Formula: Risk-Reward Ratio = Stop Loss Distance ÷ Take Profit Distance

Entry: EUR/USD at 1.1000

Stop Loss: 1.0950 (50 pips risk)

Take Profit: 1.1100 (100 pips reward)

Ratio: 50 ÷ 100 = 1:2

Interpretation: Risk $1 to make $2

Real Trading Examples

Setup: GBP/USD long at 1.2500

Stop Loss: 1.2450 (50 pips)

Take Profit: 1.2650 (150 pips)

Ratio: 1:3

Win Rate Needed: 25%

Profit Potential: $300 per $100 risk

Setup: USD/JPY short at 110.00

Stop Loss: 110.50 (50 pips)

Take Profit: 109.50 (50 pips)

Ratio: 1:1

Win Rate Needed: 50%+

Profit Potential: $50 per $50 risk

Setting Appropriate Risk-Reward Ratios

By Trading Style

⚡ Scalping (1:1 to 1:1.5)

- Quick in-and-out trades

- High-frequency approach

- Tight stops and targets

- Requires high win rates

- Lower risk per trade

📊 Swing Trading (1:2 to 1:3)

- Multi-day holds

- Moderate frequency

- Wider stops and targets

- Can tolerate lower win rates

- Higher profit per trade

📈 Day Trading (1:1.5 to 1:2)

- Same-day positions

- Balanced approach

- Technical level based

- Moderate win rates needed

- Good for beginners

🏗️ Position Trading (1:3 to 1:5+)

- Long-term trends

- Low frequency

- Very wide targets

- Can win 20-30% of trades

- Maximum profit per trade

Risk-Reward Ratio in Different Market Conditions

Trending Markets

Ranging Markets

High Volatility

Common Risk-Reward Ratio Mistakes

- Setting unrealistic targets: Taking profits too far from realistic levels

- Tight stops with tight targets: Creating 1:1 ratios that require high win rates

- Moving targets greedily: Always wanting more profit after setting targets

- Not considering market conditions: Using same ratio in all environments

- Ignoring time factors: Not accounting for how long targets take to reach

- Emotional target setting: Making targets based on hope, not analysis

Advanced Risk-Reward Concepts

1. Variable Risk-Reward

🎯 Dynamic Ratio Adjustment

Concept: Adjust risk-reward based on setup quality and market conditions.

- High-Quality Setups: Use wider ratios (1:3, 1:4)

- Average Setups: Use moderate ratios (1:2)

- Marginal Setups: Use tight ratios (1:1.5)

- News Trading: Often forced 1:1 due to volatility

2. Partial Risk-Reward

Entry: Long EUR/USD at 1.1000

Stop Loss: 1.0950 (50 pips)

Target 1: 1.1075 (75 pips, 1:1.5 ratio - take 50%)

Target 2: 1.1150 (150 pips, 1:3 ratio - take 50%)

Result: Average ratio becomes more favorable as position scales out

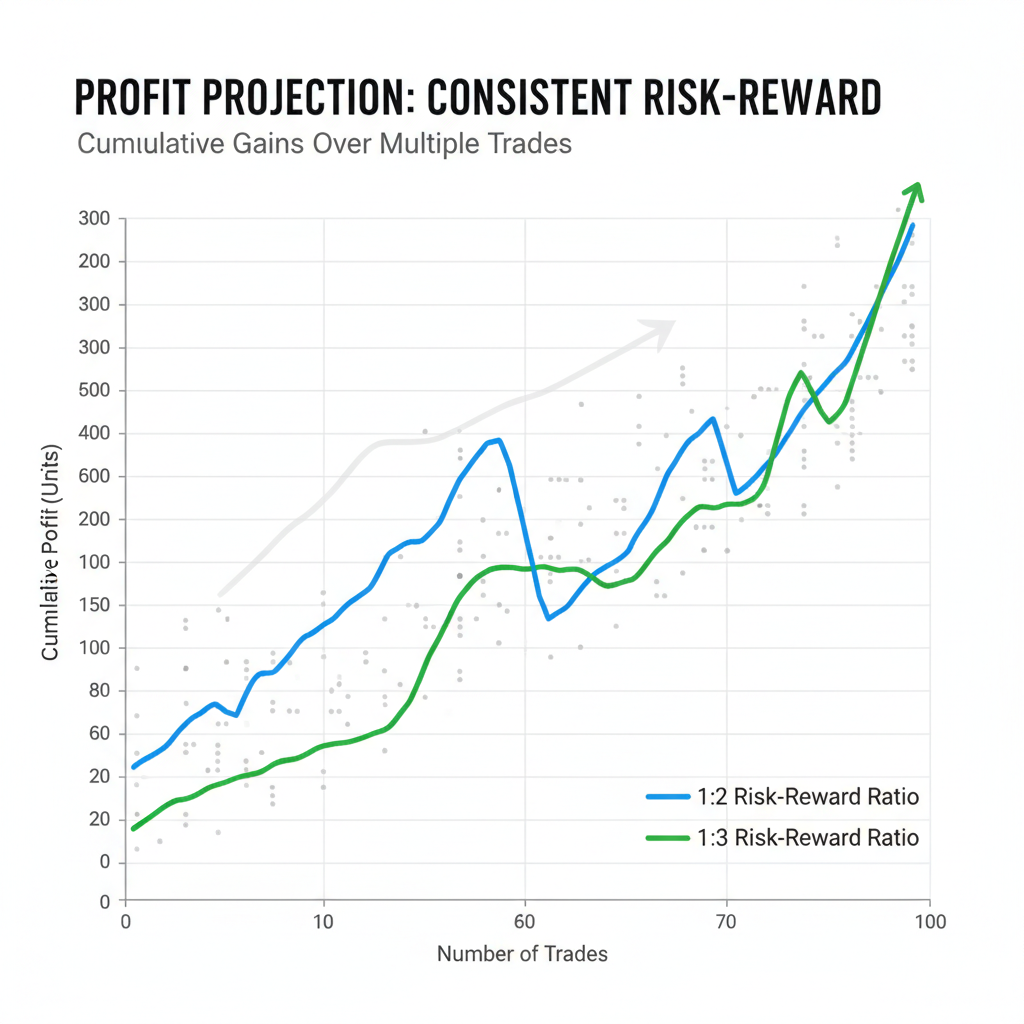

3. Expected Value Calculation

📊 Expected Value Formula

Formula: EV = (Win Rate × Average Win) - (Loss Rate × Average Loss)

Win Rate: 40%

Average Win: $200 (1:2 ratio, $100 risk)

Average Loss: $100 (stop loss hit)

EV: (0.4 × $200) - (0.6 × $100) = $80 - $60 = $20 per trade

Result: Positive expected value, profitable long-term

Building Your Risk-Reward Strategy

🎯 Step-by-Step Ratio Planning

Step 1: Choose Your Base Ratio

- Beginner: Start with 1:2 (33% win rate needed)

- Intermediate: Use 1:2.5 to 1:3 (25-29% win rate needed)

- Advanced: Scale to 1:3+ (below 25% win rate acceptable)

Step 2: Set Technical Levels

- Identify entry point based on your strategy

- Find logical stop loss level (support/resistance)

- Identify realistic take profit level

- Calculate ratio and adjust if needed

Step 3: Test and Refine

- Track actual ratios achieved

- Review monthly performance

- Adjust ratios based on results

- Maintain consistency across trades

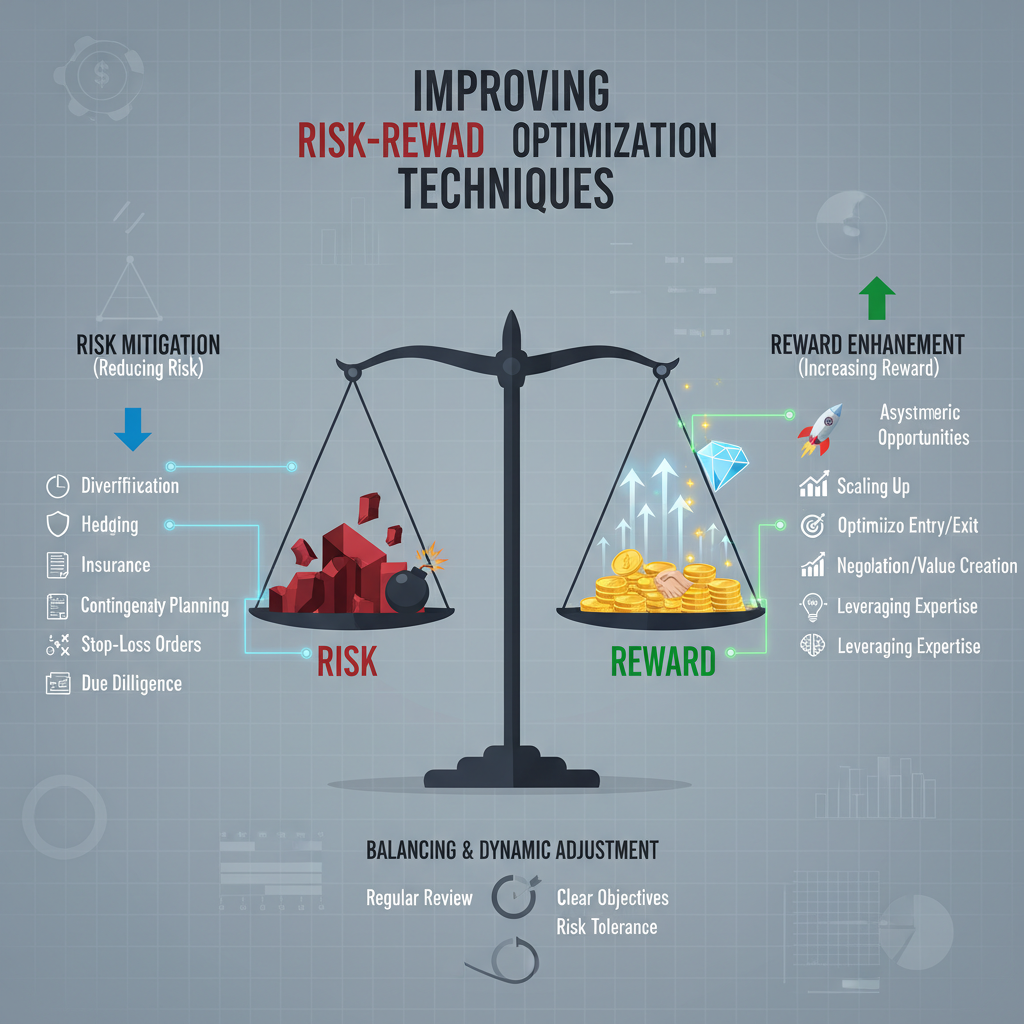

Risk-Reward Ratio Optimization

Techniques for Better Ratios

📈 Improving Reward Side

- Trade with the major trend

- Set targets at major S/R levels

- Use Fibonacci extensions

- Consider market structure

- Wait for clear breakouts

📉 Improving Risk Side

- Set stops at logical technical levels

- Use appropriate position sizing

- Avoid over-leveraging

- Account for market volatility

- Set stops beyond obvious levels

Market Structure Considerations

- Uptrends: Set wider targets above resistance levels

- Downtrends: Set wider targets below support levels

- Consolidation: Use tighter targets within range

- Breakouts: Measure previous range for targets

Conclusion

The risk-reeward ratio is the mathematical foundation that separates professional traders from amateurs. While most retail traders struggle with 1:1 ratios that require high win rates, smart traders use favorable ratios that allow for lower win rates while maintaining profitability.

Mastering risk-reward ratios requires:

- Understanding the mathematics behind profitable trading

- Setting realistic ratios based on your trading style

- Maintaining consistency across your trades

- Adapting to market conditions when appropriate

- Focusing on expected value rather than individual trades

Remember that the goal isn't to win most of your trades—it's to make more money on your winners than you lose on your losers. A well-designed risk-reward ratio makes this possible even with moderate win rates.

No comments