🎯 Professional Trader Interview

Inside the Mind of a Currency Market Expert

Gain exclusive insights from a professional forex trader with over 15 years of experience. Learn about real trading psychology, advanced strategies, risk management techniques, and career advice from someone who's made trading their livelihood.

📋 Table of Contents

- About Our Interviewee

- Career Journey & Background

- Trading Philosophy & Approach

- Strategy Development

- Risk Management Secrets

- Trading Psychology Insights

- Technology & Tools

- Current Market Perspectives

- Advice for Beginners

- Career Development

- Key Lessons Learned

👤 About Our Interviewee

We're privileged to interview "Michael Chen," a professional forex trader who has dedicated over 15 years to currency markets. Currently managing a proprietary trading fund and trading his personal capital, Michael shares insights from his journey from retail trader to professional fund manager.

🎯 Trader Profile: Michael Chen

🚀 Career Journey & Background

I started reading everything I could find about technical analysis and currency markets. I opened my first demo account with $10,000 virtual money and spent months just watching patterns, learning how the markets moved, and understanding the psychological aspects of trading.

That loss taught me several crucial lessons: never risk more than you can afford to lose, always use stop losses, and demo success doesn't automatically translate to live trading. I went back to demo trading for another six months before attempting another live trade.

My first professional role was as a junior trader at a medium-sized prop firm, where I traded their capital with strict risk limits. After two years of consistent performance, I was offered a partnership role and eventually started my own fund with backing from former colleagues and a few high-net-worth individuals.

🧠 Trading Philosophy & Approach

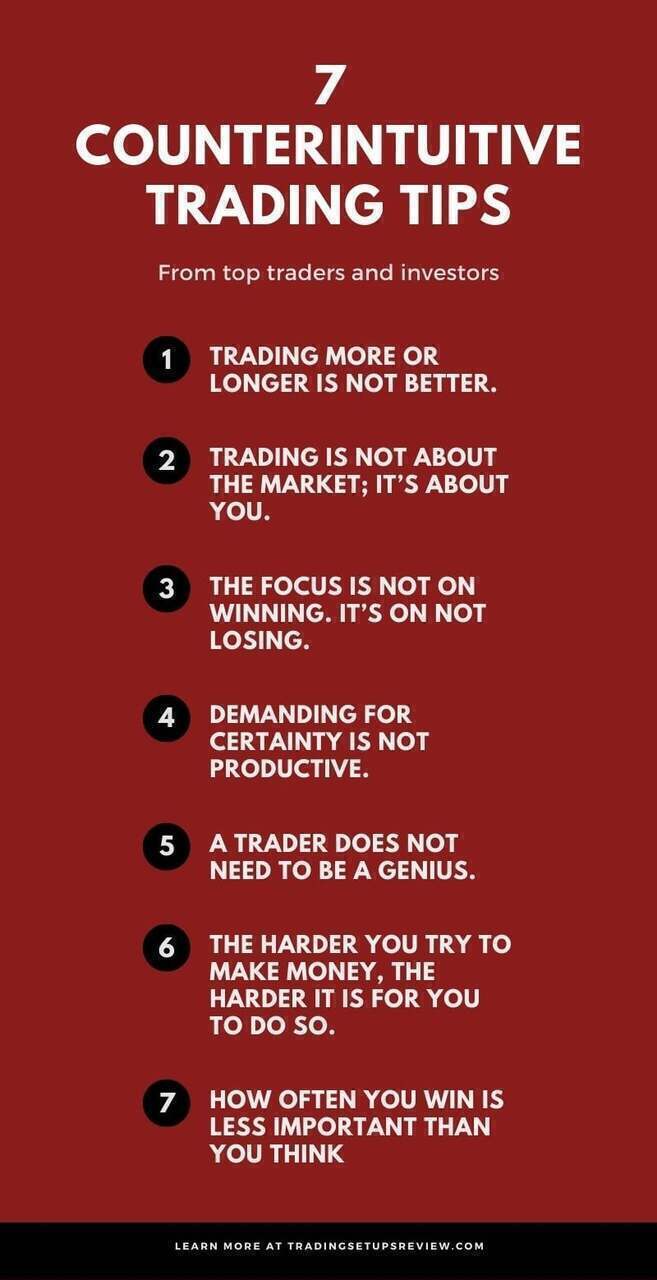

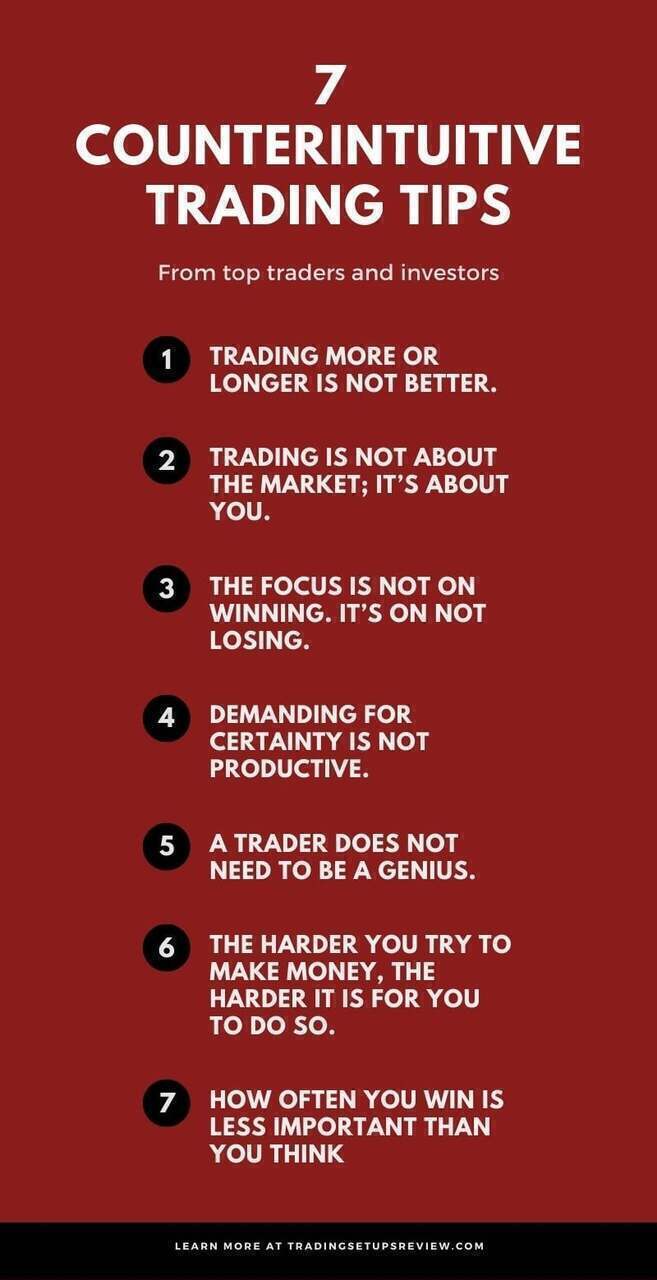

First, I think in probabilities. No trade is ever 100% certain, so I focus on setups where I have a statistical edge over many repetitions. Second, I always ask "how much could I lose?" before "how much could I make?" This risk-first approach has saved my career more times than I can count. Third, I constantly evolve my strategies because markets change, and yesterday's edge might be tomorrow's liability.

For me, success means being able to sleep well at night, knowing that my risk management is sound and my position sizing is appropriate. It also means being able to replicate my results consistently across different market conditions.

Another misconception is that professional trading is all about complex strategies and high-frequency execution. While technology plays a role, successful professional trading is often about simple strategies executed consistently and with proper risk management.

🎯 Strategy Development

Next, I develop specific entry and exit rules and test them rigorously on historical data. But here's the key—I'm not looking for strategies that worked perfectly in the past; I'm looking for strategies that have a mathematical edge and can potentially adapt to changing conditions. I'll test a new strategy in a simulated environment for at least six months before risking real capital.

I also use currency carry strategies when interest rate differentials are favorable, and I have several event-driven strategies that capitalize on market volatility around major economic announcements. The key is having multiple strategies that perform well in different market conditions—trending markets, ranging markets, high volatility, low volatility.

I also avoid optimizing too many parameters at once. Simple strategies with fewer variables are more likely to generalize well to future market conditions. Most importantly, I monitor how well my strategies perform in real-time and am willing to retire strategies that stop working, even if they were profitable in the past.

🛡️ Risk Management Secrets

1. Position Level: Never risk more than 1-2% of total capital on any single trade.

2. Portfolio Level: No single currency should represent more than 15% of total portfolio risk.

3. Daily Level: If I lose more than 3% in a single day, I stop trading and reassess.

4. Weekly/Monthly Level: I have predefined drawdown limits that trigger strategy reviews.

5. Correlated Risk: I actively monitor correlation between my positions to avoid over-exposure to the same theme.

Volatility: Higher volatility markets get smaller positions.

Conviction: Higher conviction trades might get 1.5-2x normal size.

Market Conditions: I'll reduce size during uncertain or volatile periods.

Correlation: I adjust positions based on existing portfolio exposures.

I also use the Kelly Criterion as a starting point for position sizing but never use the full Kelly amount—usually about 25-50% of the calculated optimum to account for estimation error.

For take profits, I use a tiered approach: I might take partial profits at 1:1 risk-reward, trail stops using technical levels, and leave a portion to potentially catch larger moves. I'm not wedded to specific ratios—my take profit levels are dynamic based on market conditions and technical factors.

🧘 Trading Psychology Insights

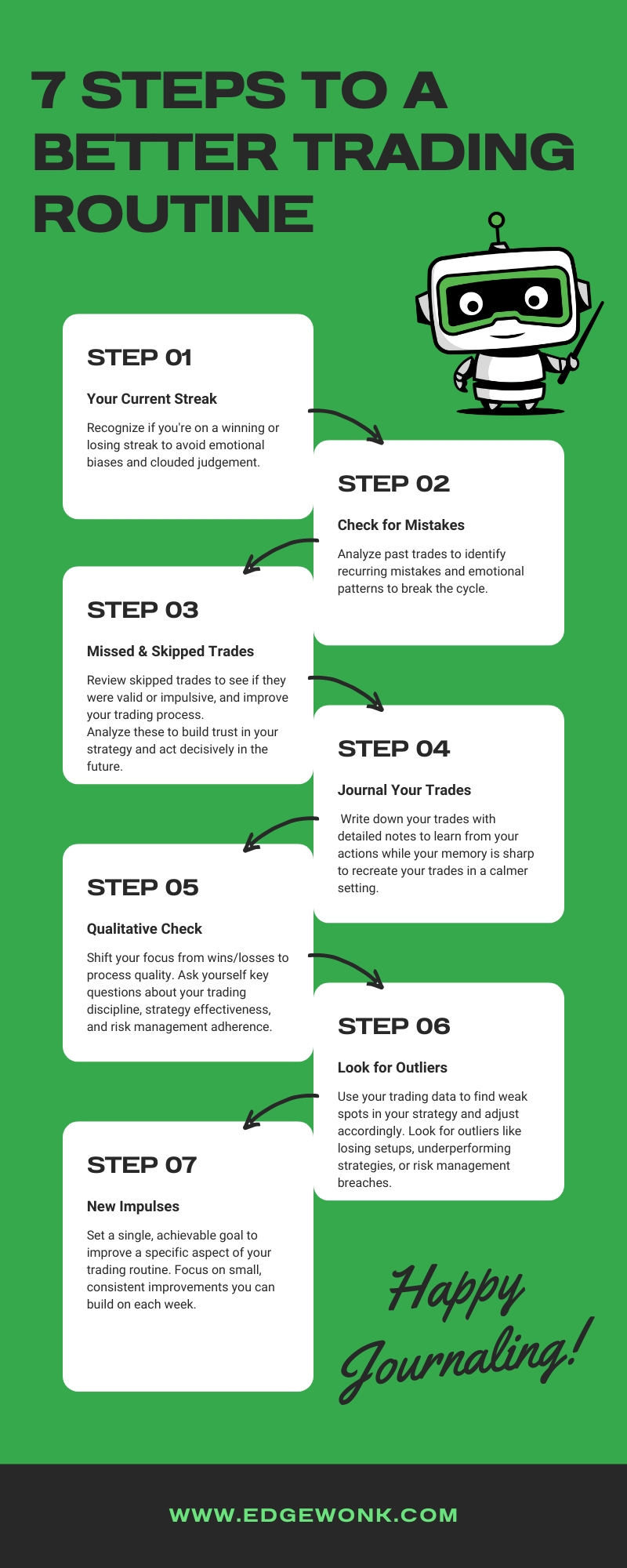

Routine: I follow the same pre-market routine every day, which helps me get into the right mindset.

Separation: I keep a detailed trading journal that helps me analyze decisions objectively rather than emotionally.

Meditation: Daily meditation has been crucial for managing stress and maintaining focus.

Perspective: I remember that any single trade is just one data point in a long series of trades.

I also work with a trading psychologist who helps me identify cognitive biases and develop better decision-making frameworks.

Overconfidence makes me want to increase position sizes or take riskier trades. I combat this by predefining position sizes and never deviating from my rules, regardless of how confident I feel.

Fear makes me want to avoid trades or cut winners short. I combat this by remembering that losses are part of the business and focusing on process rather than outcomes.

I also maintain detailed records and regularly review them to ensure I'm following my trading plan. Having other traders and accountability partners helps tremendously—it's much harder to break rules when someone else is watching.

💻 Technology & Tools

I have custom-built analytics tools that help me identify patterns, monitor risk, and analyze performance. These tools integrate with Bloomberg terminals and other market data sources to give me comprehensive market intelligence.

For execution, I use a combination of manual trading and algorithmic systems. About 60% of my trades are executed manually based on my discretion, while 40% are executed by algorithms when I've identified systematic patterns or when market conditions favor automated execution.

That said, professional-grade technology is essential for executing sophisticated strategies and managing risk properly. I need reliable, fast execution; comprehensive market data; and robust risk management tools. Technology also helps me analyze large amounts of data and identify patterns that would be impossible to spot manually.

📊 Current Market Perspectives

Dollar Strength: The USD remains strong due to higher interest rates and economic resilience. However, I expect this to moderate as other central banks catch up.

EUR Weakness: The Euro faces headwinds from slower growth and political uncertainty. The ECB's accommodative policy versus Fed tightening creates headwinds for EUR/USD.

Emerging Markets: Select EM currencies offer opportunities as their central banks become more hawkish, but selectivity is crucial given global volatility.

Volatility: Overall forex volatility is increasing, which creates more opportunities for skilled traders but requires better risk management.

When markets transition from low to high volatility, I reduce position sizes and focus on simpler strategies. When volatility decreases, I can afford to take more risk and use more complex strategies.

I'm also constantly studying new strategies and market phenomena. What worked five years ago might not work today, so I need to evolve or risk becoming obsolete.

🎓 Advice for Beginners

Spend at least 6-12 months learning and practicing on demo accounts. Develop a trading plan, test it thoroughly, and prove to yourself that you can be consistently profitable before risking real money.

Also, start small—very small. Even when you transition to live trading, use position sizes that are so small that losing won't affect your lifestyle or psychology.

1. Overleveraging: Using too much margin and risking too much per trade.

2. No risk management: Not using stop losses or position sizing rules.

3. Strategy hopping: Constantly changing strategies instead of mastering one.

4. Emotional trading: Making decisions based on fear or greed rather than analysis.

5. Unrealistic expectations: Expecting to get rich quick.

6. Lack of patience: Not waiting for the right setups.

All of these mistakes are avoidable with proper education and discipline.

6-12 months: Education and demo trading

12-18 months: Initial live trading with small sizes

18-24 months: Strategy refinement and consistency development

24-36 months: Advanced skill development and scaling

This timeline assumes dedicated effort and proper mentorship. Some talented individuals might achieve profitability faster, but this is the realistic timeframe for most people.

🚀 Career Development

Proprietary Trading Firms: These are often the best entry point. They provide capital, training, and mentorship in exchange for a percentage of profits.

Hedge Funds: More competitive but offer excellent training and resources.

Banks: Investment banks hire traders for their trading desks, though this often involves more risk management than independent trading.

Build Your Own Fund: The hardest path but potentially most rewarding—requires significant capital and proven track record.

Regardless of the path, you need a documented track record of consistent profitability.

Quantitative Skills: Understanding statistics, probability, and risk management.

Technology Proficiency: Comfort with trading platforms, data analysis, and sometimes programming.

Communication Skills: Ability to explain your strategies and rationale to colleagues and investors.

Stress Management: Ability to perform under pressure and handle significant financial responsibility.

Continuous Learning: Markets evolve constantly, so the ability to learn and adapt is crucial.

Ethics and Integrity: High ethical standards are essential in this industry.

📚 Key Lessons Learned

📈 Final Thoughts

"Trading can be a wonderful career for the right person, but it's not easy money and it certainly isn't quick. It requires years of dedicated learning, consistent application of sound principles, and the psychological resilience to handle significant financial pressure. If you're considering this path, make sure you're in it for the long haul and are willing to do the hard work required to develop the skills necessary for success."

📚 Conclusion

This interview with Michael Chen provides valuable insights into the world of professional forex trading. His experiences highlight the importance of proper education, disciplined risk management, psychological preparation, and continuous learning. Whether you're aspiring to become a professional trader or simply looking to improve your retail trading skills, these insights from someone who's successfully navigated the challenges of currency markets can prove invaluable.

• Education first - spend years learning before risking significant capital

• Risk management is paramount - protect capital above all else

• Psychology trumps strategy - emotional discipline determines success

• Adaptation is essential - markets evolve, so must your skills

• Patience and persistence - successful trading takes time and dedication

Learn from the mistakes and recovery strategies of other traders in our next article about forex trading mistakes recovery.

📈 Complete Your Education:

→ Forex Trading Mistakes

Recovery |

← From $100 to $10,000

Journey

No comments