Position Sizing in Forex: Calculate the Perfect Trade Size Every Time

Position sizing determines exactly how much of your account you'll risk on each trade. It's the bridge between your trading strategy and your account balance. Master this one skill, and you'll avoid the most common cause of account blow-ups among retail traders.

Understanding Position Sizing Fundamentals

What is Position Sizing?

Position sizing is the process of determining how many lots (units) to trade based on your account balance, risk percentage, stop loss distance, and the specific currency pair's pip value.

🎯 The Position Sizing Formula

Breaking Down the Formula:

- Account Balance: Your current trading account size

- Risk %: Percentage of account you're willing to lose (typically 1-2%)

- Stop Loss in Pips: Distance from entry to stop loss in pips

- Pip Value: How much one pip is worth per standard lot

Why Position Sizing Matters

✅ Consequences of Proper Sizing

- Consistent risk across all trades

- Ability to survive losing streaks

- Gradual, sustainable account growth

- Emotional stability during trading

- Professional trading approach

❌ Consequences of Improper Sizing

- Inconsistent risk per trade

- Account destruction from single trade

- Emotional trading decisions

- Inability to recover from losses

- Amateur trading approach

Understanding Pip Values

What is a Pip?

A pip (Percentage in Point) is the smallest price move a currency pair can make. For most pairs, it's 0.0001 (the fourth decimal place). For Japanese Yen pairs, it's 0.01 (the second decimal place).

Pip Values by Currency Pair Type

| Pair Type | Examples | Pip Location | Standard Lot Value | Mini Lot Value | Micro Lot Value |

|---|---|---|---|---|---|

| Major USD Pairs | EUR/USD, GBP/USD, AUD/USD | 4th decimal | $10.00 | $1.00 | $0.10 |

| JPY Pairs | USD/JPY, EUR/JPY, GBP/JPY | 2nd decimal | $9.26 | $0.93 | $0.09 |

| Cross Pairs | EUR/GBP, EUR/CHF, GBP/CHF | 4th decimal | $13.50 | $1.35 | $0.14 |

| Exotic Pairs | USD/TRY, EUR/ZAR, GBP/SGD | Varies | Varies | Varies | Varies |

Calculating Pip Values for Cross Pairs

📊 Manual Pip Value Calculation

Formula for Cross Pairs:

Example: EUR/GBP at 0.8500

Step 2: Pip movement = 0.0001

Step 3: Pip Value = (1 × 0.0001) ÷ 0.8500 = 0.0001176

Step 4: Convert to USD: 0.0001176 × GBP/USD rate (1.2500) = $0.147

Result: 1 pip = $0.147 per standard lot

Step-by-Step Position Sizing Calculation

Complete Position Sizing Example

Trade Setup Details:

- Account Balance: $25,000

- Risk Per Trade: 1% = $250

- Currency Pair: GBP/USD

- Entry Price: 1.2500

- Stop Loss: 1.2450 (50 pips)

- Current GBP/USD Rate: 1.2500

Calculation Steps:

Final Answer: Trade 0.5 standard lots

Position Sizing by Account Size

Different Account Sizes, Different Approaches

💰 Small Accounts ($500 - $5,000)

- Risk Per Trade: 0.5-1% maximum

- Lot Sizes: Focus on micro lots (0.01) and mini lots (0.1)

- Currency Pairs: Stick to major pairs only

- Example: $1,000 account with 1% risk = $10 maximum risk per trade

| Account Size | 1% Risk | Max Stop Loss | Position Size (EUR/USD) |

|---|---|---|---|

| $500 | $5 | 50 pips | 0.01 lots |

| $1,000 | $10 | 100 pips | 0.01 lots |

| $2,500 | $25 | 50 pips | 0.05 lots |

| $5,000 | $50 | 50 pips | 0.1 lots |

💰 Medium Accounts ($5,000 - $50,000)

- Risk Per Trade: 1-2% maximum

- Lot Sizes: Standard lots (1.0) and mini lots (0.1)

- Currency Pairs: Can include major and some minor pairs

- Example: $25,000 account with 1% risk = $250 maximum risk per trade

| Account Size | 1% Risk | Max Stop Loss | Position Size (EUR/USD) |

|---|---|---|---|

| $10,000 | $100 | 100 pips | 0.1 lots |

| $25,000 | $250 | 50 pips | 0.5 lots |

| $50,000 | $500 | 100 pips | 0.5 lots |

💰 Large Accounts ($50,000+)

- Risk Per Trade: 0.5-1% maximum (still conservative)

- Lot Sizes: Multiple standard lots

- Currency Pairs: Full range including exotics

- Example: $100,000 account with 1% risk = $1,000 maximum risk per trade

Position Sizing for Different Currency Pairs

Major USD Pairs (EUR/USD, GBP/USD, AUD/USD, NZD/USD)

📈 Quick Reference Chart - Major USD Pairs

| Stop Loss | Position Size (Account: $10K) | Position Size (Account: $25K) | Position Size (Account: $50K) |

|---|---|---|---|

| 20 pips | 0.5 lots | 1.25 lots | 2.5 lots |

| 30 pips | 0.33 lots | 0.83 lots | 1.67 lots |

| 50 pips | 0.2 lots | 0.5 lots | 1.0 lots |

| 100 pips | 0.1 lots | 0.25 lots | 0.5 lots |

Based on 1% risk per trade

JPY Pairs (USD/JPY, EUR/JPY, GBP/JPY)

📈 Quick Reference Chart - JPY Pairs

| Stop Loss | Position Size (Account: $10K) | Position Size (Account: $25K) | Position Size (Account: $50K) |

|---|---|---|---|

| 20 pips | 0.54 lots | 1.35 lots | 2.7 lots |

| 30 pips | 0.36 lots | 0.9 lots | 1.8 lots |

| 50 pips | 0.22 lots | 0.54 lots | 1.08 lots |

| 100 pips | 0.11 lots | 0.27 lots | 0.54 lots |

Based on 1% risk per trade, pip value ~$9.26

Cross Pairs (EUR/GBP, EUR/CHF, GBP/CHF)

Advanced Position Sizing Techniques

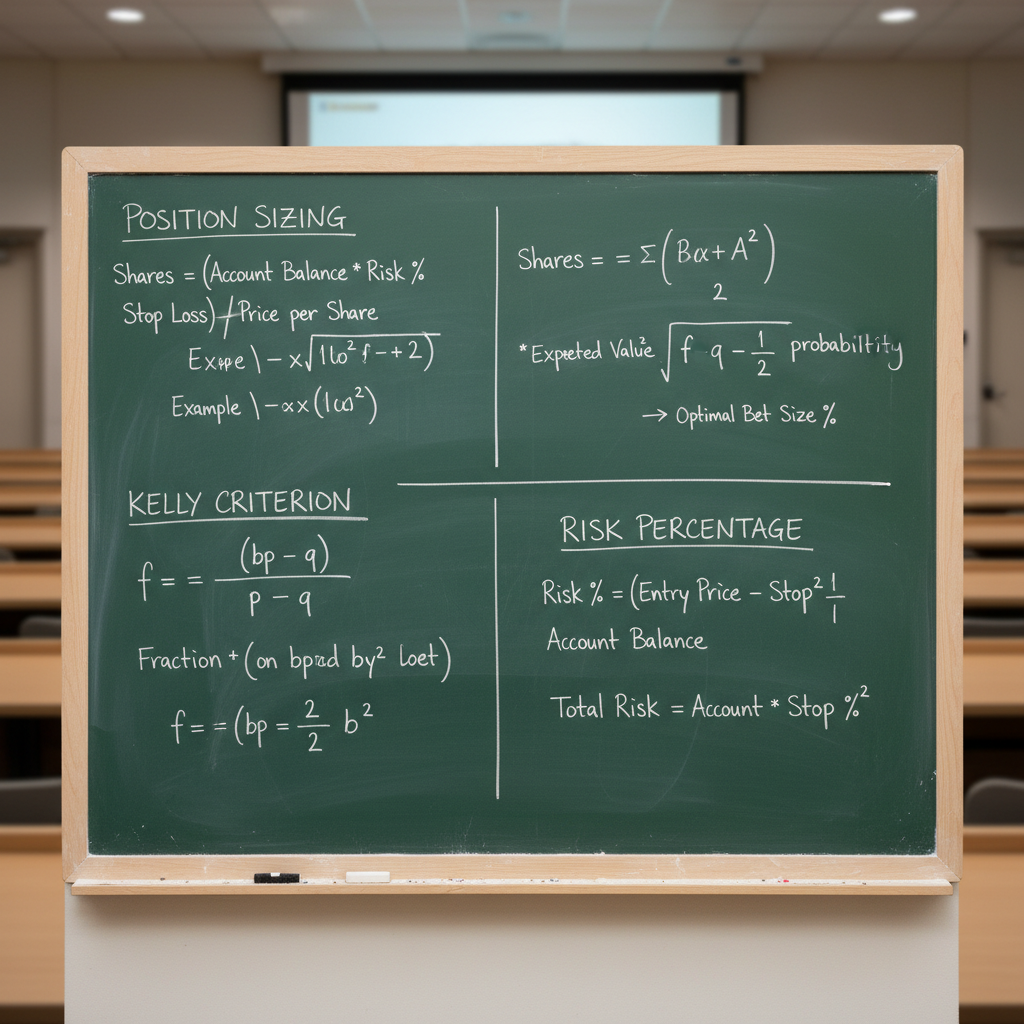

1. Kelly Criterion Position Sizing

🎯 Kelly Formula for Optimal Position Size

Kelly Formula: f = (bp - q) / b

Where:

- f = fraction of capital to risk

- b = reward-to-risk ratio

- p = probability of winning

- q = probability of losing (1 - p)

Example Calculation:

- Win Rate: 55% (p = 0.55, q = 0.45)

- Reward:Risk Ratio: 2:1 (b = 2)

- Kelly % = (2 × 0.55 - 0.45) / 2 = 32.5%

2. Fixed Dollar Risk Method

Instead of percentage-based risk, use a fixed dollar amount per trade:

💵 Fixed Dollar Risk Example

- Fixed Risk: $50 per trade (regardless of account size)

- Account A: $5,000 (1% risk)

- Account B: $50,000 (0.1% risk)

- Benefit: Consistent approach across different account sizes

3. Volatility-Adjusted Position Sizing

📊 ATR-Based Position Sizing

Concept: Adjust position size based on current market volatility

ATR Method:

- Calculate 14-day ATR for the pair

- Set stop loss at 2 × ATR

- Calculate position size based on this wider stop

Example:

- EUR/USD ATR (14) = 25 pips

- Stop Loss = 2 × 25 = 50 pips

- Position size = Risk ÷ (50 pips × $10) = normal calculation

Position Sizing Tools and Calculators

Free Online Calculators

Broker Calculators

- OANDA Position Calculator

- FXCM Position Sizing Tool

- DailyFX Risk Calculator

- BabyPips Position Calculator

Spreadsheet Templates

- Excel position size calculator

- Google Sheets forex calculator

- TradingView position calculator

- Custom position sizing Excel

Creating Your Own Calculator

🔧 Excel Position Size Calculator

Setup Required Columns:

- Account Balance (Cell A1)

- Risk Percentage (Cell B1)

- Currency Pair (Cell C1)

- Entry Price (Cell D1)

- Stop Loss Price (Cell E1)

- Calculated Position Size (Cell F1)

Key Formulas:

Common Position Sizing Mistakes

- Guessing position size: Never estimate—always calculate

- Using wrong pip values: Different pairs have different pip values

- Forgetting minimum lot sizes: Check broker's minimum trade size

- Ignoring spreads: Factor in bid-ask spread when setting stops

- Not accounting for leverage: Position size affects margin requirements

- Changing risk mid-trade: Don't adjust size after entering position

- Not rounding appropriately: Use broker-acceptable lot sizes

Position Sizing for Different Trading Styles

Scalping Position Sizing

⚡ Scalping Approach

- Stop Losses: 5-15 pips typically

- Risk Per Trade: 0.5-1% (lower due to high frequency)

- Position Sizes: Larger due to tight stops

- Example: $10K account, 1% risk, 10-pip stop = 1.0 lots on EUR/USD

Swing Trading Position Sizing

📈 Swing Trading Approach

- Stop Losses: 50-150 pips typically

- Risk Per Trade: 1-2% standard

- Position Sizes: Smaller due to wider stops

- Example: $25K account, 1% risk, 100-pip stop = 0.25 lots on EUR/USD

Position Trading Position Sizing

📊 Position Trading Approach

- Stop Losses: 200-500 pips or more

- Risk Per Trade: 0.5-1% (conservative due to large stops)

- Position Sizes: Very small due to wide stops

- Example: $50K account, 1% risk, 300-pip stop = 0.17 lots on EUR/USD

Building a Position Sizing Routine

✅ Pre-Trade Position Sizing Checklist

- ✅ Calculate your current account balance

- ✅ Determine your risk percentage for this trade

- ✅ Identify your entry and stop loss levels

- ✅ Calculate stop loss distance in pips

- ✅ Look up the pip value for your currency pair

- ✅ Calculate position size using the formula

- ✅ Round to broker-acceptable lot size

- ✅ Verify the calculated risk matches your intended risk

- ✅ Check margin requirements for the position

Position Sizing Best Practices

Professional Guidelines

- Always calculate before entering: Never guess your position size

- Use position size calculators: Eliminate human error

- Keep risk consistent: Same risk percentage for all trades

- Factor in correlation: Reduce size when positions are correlated

- Adjust for volatility: Use wider stops in volatile markets

- Monitor margin usage: Don't over-leverage your account

Conclusion

Position sizing is the foundation of professional forex trading. It's what separates amateur traders who guess their position sizes from professionals who calculate them precisely every time. Master this skill, and you'll join the small percentage of traders who consistently grow their accounts over time.

Mastering position sizing requires:

- Understanding pip values for different currency pairs

- Memorizing the position sizing formula and using it consistently

- Using tools and calculators to eliminate errors

- Applying the same risk percentage to all trades

- Building a routine that ensures you calculate before every trade

Remember that position sizing is not about making more money—it's about protecting the money you have. The traders who survive long-term are those who understand that consistent small risks lead to sustainable long-term growth.

No comments