Forex Risk Management: The Complete Guide to Protecting Your Capital

In forex trading, knowledge without risk management is like a ship without a compass—you might know where you want to go, but you'll never get there. Risk management isn't just about protecting your money; it's about ensuring you have enough capital to keep trading long enough to become profitable.

The Foundation: Why Risk Management is Everything

Most new traders focus entirely on finding winning trades, but they forget the most important element: keeping the money they make. This is the paradox of trading—the better you get at risk management, the better you'll perform financially, even if your win rate stays the same.

The Mathematics of Risk

Poor Risk Management Example

- Win Rate: 70%

- Risk per Trade: 5%

- Reward:Risk: 1:1

- After 10 trades: +35% -50% = -15%

Good Risk Management Example

- Win Rate: 50%

- Risk per Trade: 1%

- Reward:Risk: 2:1

- After 10 trades: +10% -5% = +5%

Core Principles of Forex Risk Management

1. The 1% Rule

🎯 The Golden Rule: Risk Only 1-2% Per Trade

Never risk more than 1-2% of your total account balance on a single trade. This ensures that even a series of losses won't significantly damage your trading capital.

Why 1-2%?

- Psychological Comfort: Small losses are easier to accept and move past

- Survival Factor: You can survive 20+ consecutive losses and still trade

- Compound Growth: Allows steady, sustainable account growth

- Emotional Stability: Prevents fear-based trading decisions

1% Rule Calculation Example

Account Balance: $10,000

Maximum Risk Per Trade: 1% = $100

Trade Setup: EUR/USD Long at 1.1000, Stop Loss at 1.0950 (50 pips)

Position Size Calculation:

- Risk amount: $100

- Stop distance: 50 pips

- Pip value for EUR/USD: ~$10 per standard lot

- Position Size: $100 ÷ (50 × $10) = 0.2 lots

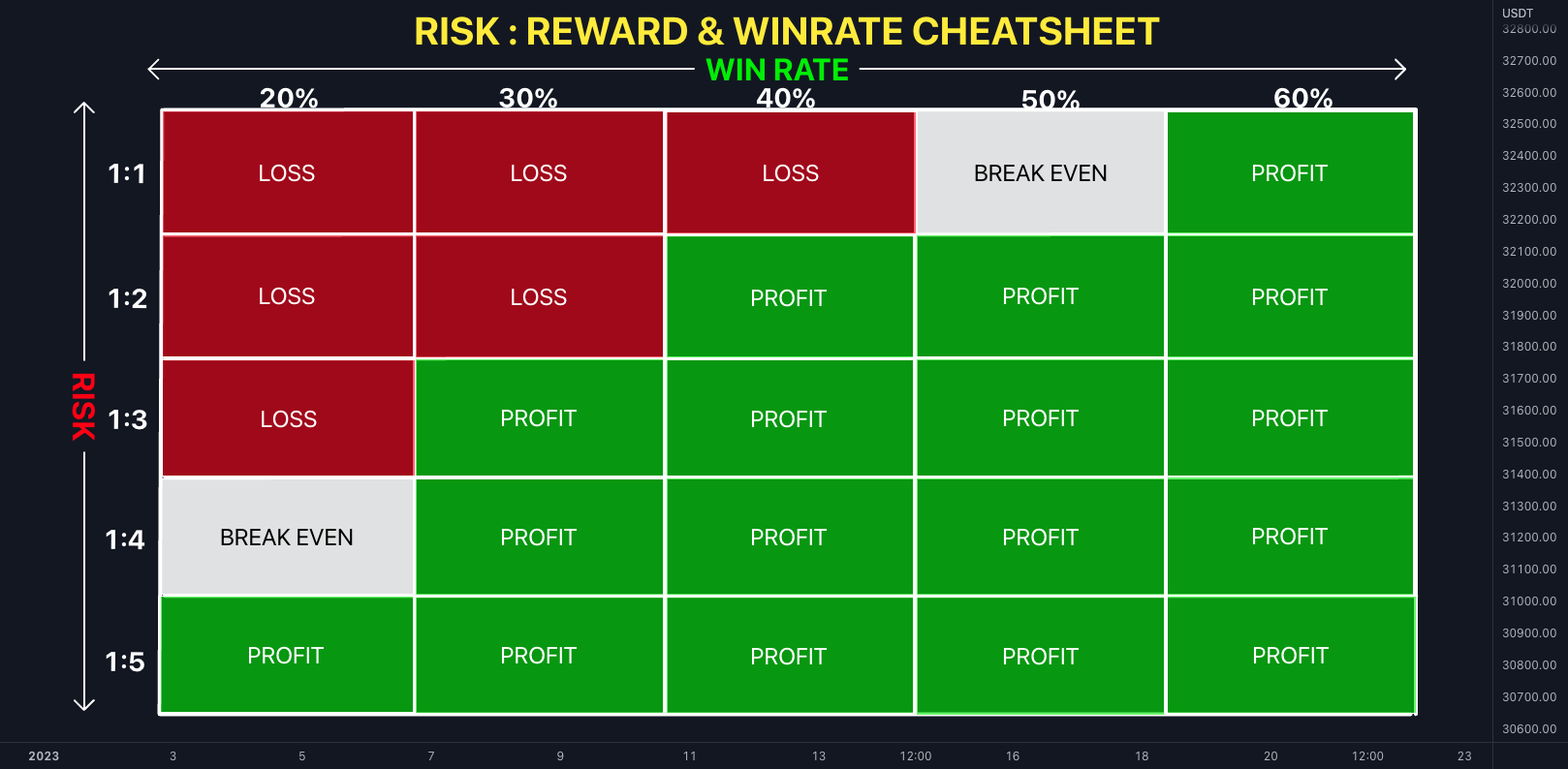

2. The Risk-to-Reward Ratio

Minimum 1:2 Risk-Reward Ratio

Never enter a trade where your potential profit is less than twice your potential loss. This ensures profitability even with a win rate below 50%.

| Win Rate | 1:1 R:R | 1:2 R:R | 1:3 R:R |

|---|---|---|---|

| 40% | -20% | +20% | +80% |

| 50% | 0% | +50% | +100% |

| 60% | +20% | +80% | +180% |

Net profit after 10 trades with 1% risk per trade

3. Maximum Daily and Weekly Loss Limits

📉 Setting Loss Limits

- Daily Loss Limit: 3-5% of account balance

- Weekly Loss Limit: 10-15% of account balance

- Monthly Loss Limit: 20% of account balance

When you hit these limits, stop trading immediately. The goal is to preserve capital for better trading days ahead.

Position Sizing: The Cornerstone of Risk Management

Understanding Position Sizing

Position sizing determines how much of your account you'll risk on each trade. It's the most important skill in forex trading because it directly controls your potential profits and losses.

Position Sizing Formula

Position Size = (Account Balance × Risk%) ÷ (Stop Loss in Pips × Pip Value)

Example Calculation:

- Account: $50,000

- Risk per trade: 1% = $500

- Stop loss: 30 pips

- Pip value: $10 (standard lot EUR/USD)

- Position size: $500 ÷ (30 × $10) = 1.67 lots

Pip Value for Different Pairs

| Currency Pair | Pip Value (Standard Lot) | Example Stop Loss | Risk on $10,000 (1% risk) |

|---|---|---|---|

| EUR/USD | $10.00 | 30 pips | $300 (0.3 lots) |

| GBP/USD | $10.00 | 40 pips | $400 (0.25 lots) |

| USD/JPY | $9.26 | 35 pips | $324 (0.29 lots) |

| EUR/GBP | $13.50 | 25 pips | $337.50 (0.22 lots) |

Stop Loss Strategies

Types of Stop Losses

1. Fixed Percentage Stop

Example: Always place stop 2% below entry for long positions

Pros: Simple, consistent risk

Cons: Ignores market structure

2. Technical Stop

Example: Place stop below support level

Pros: Respects market structure

Cons: Variable risk per trade

3. Volatility-Based Stop

Example: 2 × ATR (Average True Range)

Pros: Adapts to market conditions

Cons: May be too wide in quiet markets

4. Time-Based Stop

Example: Close position if no movement after X hours

Pros: Avoids dead money

Cons: May close profitable trades early

Recommended Stop Loss Approach

Combine Technical and Volatility Analysis:

- Identify technical level (support/resistance)

- Check current ATR for market volatility

- Set stop at technical level, but minimum 1.5 × ATR

- Ensure total risk doesn't exceed 1% of account

Portfolio Diversification in Forex

Currency Diversification

🌍 Don't Over-Concentrate in One Currency

Avoid taking multiple positions in the same currency or highly correlated pairs simultaneously.

Bad Example:

- Long EUR/USD (long EUR, short USD)

- Long GBP/USD (long GBP, short USD)

- Long EUR/GBP (long EUR, short GBP)

Problem: Massive EUR exposure with minimal USD and GBP diversification.

Better Example:

- Long EUR/USD (long EUR, short USD)

- Long AUD/USD (long AUD, short USD)

- Short USD/JPY (short USD, long JPY)

Benefit: Balanced exposure across multiple currency themes.

Time Diversification

- Avoid multiple positions during the same news event

- Don't cluster all trades in one trading session

- Consider different holding periods (scalp, day trade, swing trade)

Advanced Risk Management Techniques

1. Kelly Criterion Position Sizing

📊 Kelly Formula for Optimal Position Size

Formula: f = (bp - q) / b

Where:

- f = fraction of capital to risk

- b = odds received on the trade (reward:risk ratio)

- p = probability of winning

- q = probability of losing (1 - p)

Example:

- Win rate: 50% (p = 0.5, q = 0.5)

- Reward:Risk: 2:1 (b = 2)

- Kelly % = (2 × 0.5 - 0.5) / 2 = 25%

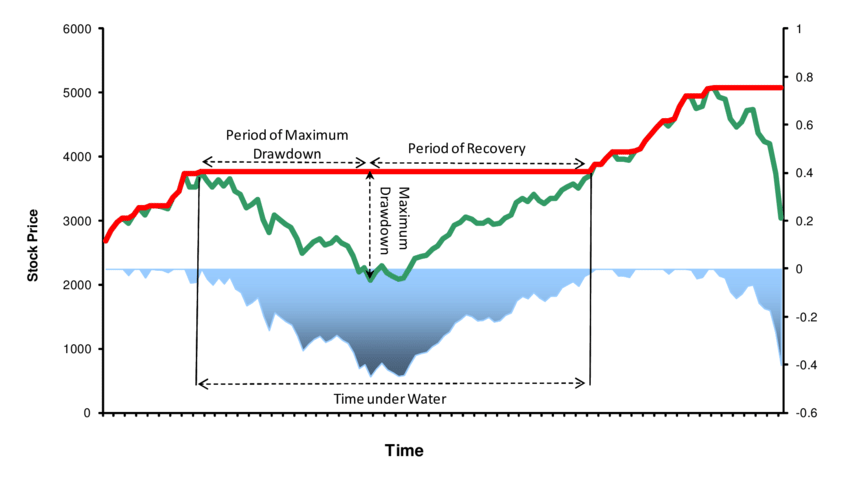

2. Maximum Drawdown Protection

📈 Protecting Against Large Drawdowns

- Maximum Drawdown: Set at 15-20% of account balance

- Recovery Plan: If hit, reduce position sizes by 50%

- Account Recovery: Requires 18-25% gains to break even

- Prevention: Smaller losses are easier to recover from

3. Correlation-Based Risk Management

Psychological Aspects of Risk Management

Emotional Challenges

😰 Fear-Based Mistakes

- Moving stops further away after entering

- Taking profits too early

- Avoiding trades due to previous losses

- Reducing position sizes after losses

😡 Greed-Based Mistakes

- Moving stops after initial profit

- Increasing position sizes after wins

- Ignoring risk rules to "make it back"

- Taking unnecessary risks

Building Discipline

Risk Management Rules to Follow

- Write down your risk rules and review them daily

- Calculate position size before every trade

- Set stop loss before entering—never move it against you

- Accept that losses are part of trading

- Never risk money you can't afford to lose

- Take a break after hitting daily loss limits

Risk Management by Account Size

Different Approaches for Different Balances

💰 Small Accounts ($1,000 - $5,000)

- Risk: 0.5-1% per trade

- Focus on major pairs only

- Use micro lots or nano lots

- Build slowly and consistently

- Avoid over-leveraging

💰 Medium Accounts ($5,000 - $50,000)

- Risk: 1-2% per trade

- Can trade multiple pairs

- Standard lot sizes available

- Diversify across currency themes

- Consider swing trading strategies

💰 Large Accounts ($50,000+)

- Risk: 1% or less per trade

- Professional-level diversification

- Can use more sophisticated strategies

- Focus on portfolio approach

- May need multiple broker accounts

Common Risk Management Mistakes

- Risk too much per trade: Most retail traders risk 5-10% or more

- No stop losses: "Will it come back" is not a strategy

- Moving stops against you: Turns small losses into big losses

- Not using proper position sizing: Guessing position size leads to inconsistent risk

- Ignoring correlation: Taking multiple positions in same currency theme

- Revenge trading: Trying to "make it back" with bigger risks

- Overconfidence after wins: Taking bigger risks after profitable trades

Creating Your Risk Management Plan

Step 1: Define Your Risk Parameters

- Account size: $_______

- Maximum risk per trade: _____ %

- Maximum daily loss: _____ %

- Maximum weekly loss: _____ %

- Maximum monthly loss: _____ %

Step 2: Position Sizing Rules

- Calculate position size for every trade

- Use standard lot sizes only

- Check correlation before entering

- Set stops before entry

- Never move stops against you

Step 3: Portfolio Management

- Maximum 3-5 open positions

- No more than 60% risk in one currency

- Diversify across different themes

- Close positions before major news

- Review and adjust weekly

Risk Management Tools and Resources

Position Size Calculators

- Broker position calculators

- Online forex position size tools

- Excel/spreadsheet calculators

- Mobile apps for quick calculations

Risk Monitoring Tools

- Trading journal to track risk

- Account equity curve tracking

- Drawdown monitoring

- Risk percentage calculators

Conclusion

Risk management is not just a component of forex trading—it is forex trading. Every successful trader will tell you that protecting capital is more important than making profits. The traders who survive long-term are those who understand that consistent small wins and small losses lead to large profits over time.

Mastering risk management requires:

- Understanding the mathematics of risk and reward

- Discipline to follow rules even when emotions run high

- Consistent application of position sizing principles

- Portfolio awareness to avoid over-concentration

- Long-term perspective on trading performance

Remember that risk management rules were created by analyzing thousands of trading accounts and identifying common failure points. These rules exist because they work. Your job is not to question them but to follow them consistently.

No comments