Currency Correlation: Understanding Forex Pair Relationships

Currency correlation is one of the most important concepts in forex trading that most retail traders ignore. Understanding how currency pairs relate to each other can help you make better trading decisions, manage risk more effectively, and even increase your profits through strategic positioning.

What is Currency Correlation?

Currency correlation measures the statistical relationship between two currency pairs. It's expressed as a coefficient ranging from -1 to +1:

Correlation Coefficient Interpretation

| Correlation | Meaning | Trading Implication |

|---|---|---|

| +1.0 | Perfect positive correlation | Pairs move exactly together |

| +0.7 to +0.9 | Strong positive correlation | Pairs generally move together |

| +0.3 to +0.6 | Moderate positive correlation | Pairs sometimes move together |

| -0.3 to +0.3 | Weak correlation | Pairs move independently |

| -0.7 to -0.9 | Strong negative correlation | Pairs generally move opposite |

| -1.0 | Perfect negative correlation | Pairs move exactly opposite |

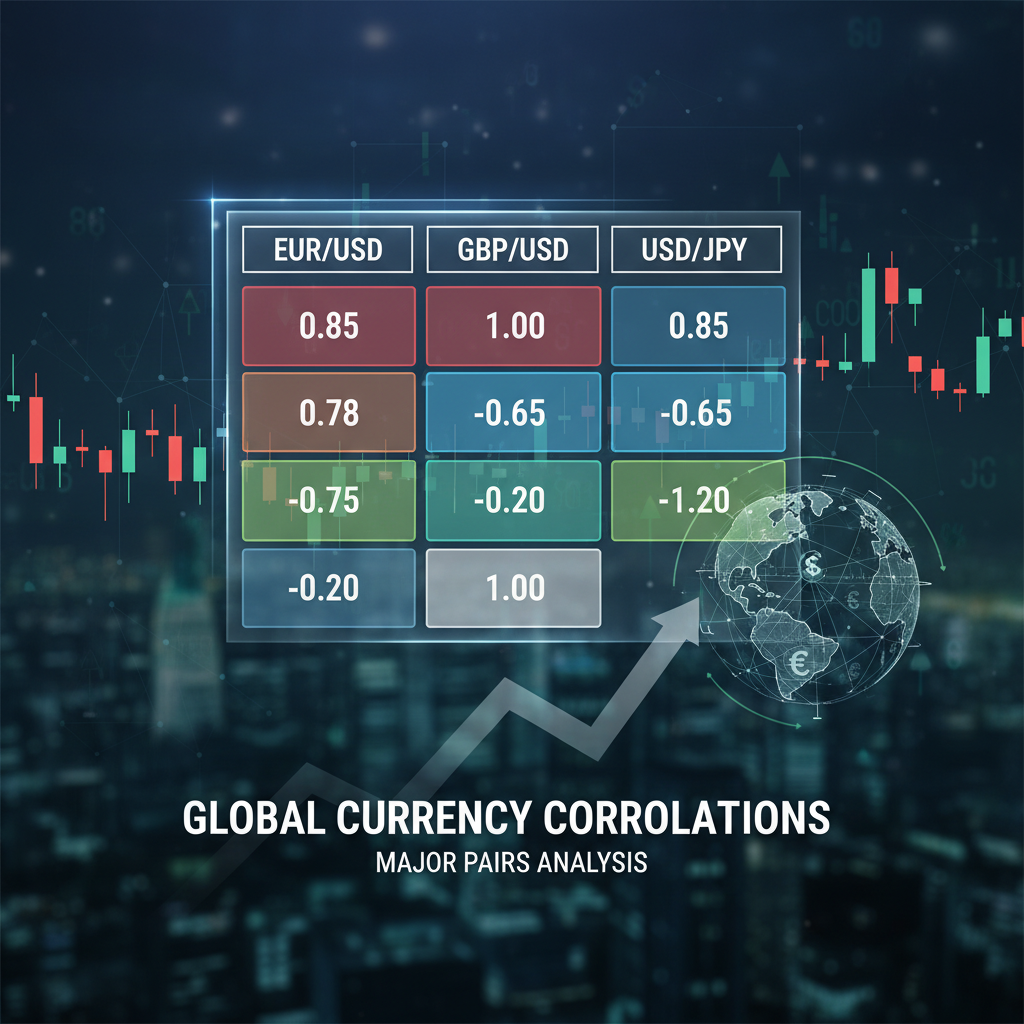

Major Currency Correlation Matrix

Daily Timeframe Correlations (Approximate Values)

| Pair | EUR/USD | GBP/USD | USD/JPY | AUD/USD | USD/CAD | NZD/USD |

|---|---|---|---|---|---|---|

| EUR/USD | 1.00 | +0.85 | -0.75 | +0.70 | -0.60 | +0.65 |

| GBP/USD | +0.85 | 1.00 | -0.65 | +0.75 | -0.55 | +0.70 |

| USD/JPY | -0.75 | -0.65 | 1.00 | -0.60 | +0.45 | -0.55 |

| AUD/USD | +0.70 | +0.75 | -0.60 | 1.00 | -0.40 | +0.80 |

| USD/CAD | -0.60 | -0.55 | +0.45 | -0.40 | 1.00 | -0.35 |

| NZD/USD | +0.65 | +0.70 | -0.55 | +0.80 | -0.35 | 1.00 |

Note: These are approximate correlations and can change based on market conditions. Always check current values.

Why Currency Correlations Exist

1. Economic Relationships

Shared Economic Factors

- Interest Rates: Central bank policies affect regional currencies similarly

- Commodity Prices: Oil affects CAD, gas affects NOK, gold affects AUD

- Risk Sentiment: Risk-on/off affects commodity and emerging market currencies

Trade Relationships

- EU-UK Trade: EUR and GBP often move together on Brexit news

- US-China Trade: Both USD and CNY can be affected

- Asia Supply Chains: KRW, TWD, SGD move with regional data

2. Market Structure

- USD as Base Currency: All USD pairs share USD exposure

- EUR as Quote Currency: EUR/GBP moves inversely to GBP/EUR

- Liquidity Effects: Major pairs often move together during high volatility

- Algorithmic Trading: Many programs trade correlated pairs simultaneously

3. Central Bank Coordination

Central banks often coordinate policy during crises, leading to correlated currency movements:

- 2008 Financial Crisis: Coordinated rate cuts led to USD strength

- 2020 COVID Response: Massive stimulus across major economies

- 2022 Inflation Fighting: Synchronized rate hiking cycles

Practical Applications of Currency Correlation

1. Risk Management

Portfolio Risk Management

Step 1: Calculate Your Exposure

- List all your open positions

- Identify the underlying currencies

- Calculate net exposure to each currency

Step 2: Assess Correlation Risk

- Check correlations between your positions

- Identify overconcentration in any currency

- Consider closing or hedging correlated positions

Example Scenario:

- Long EUR/USD: +100,000 EUR exposure

- Long GBP/USD: +100,000 GBP exposure

- Combined EUR + GBP exposure: High positive correlation risk

- Solution: Close one position or hedge with EUR/GBP

2. Hedging Strategies

Correlation Hedging

Direct Hedging:

- Example: Long EUR/USD + short EUR/GBP = USD hedge

- Result: EUR exposure hedged, USD exposure netted

- Risk: Correlation breakdown could cause losses

Indirect Hedging:

- Example: Long USD/CAD + long AUD/USD = CAD and AUD hedge against USD

- Result: Profitable if USD weakens against both CAD and AUD

- Advantage: Not directly correlated with primary position

3. Trade Confirmation

Use correlated pairs to confirm your trade direction:

- EUR/USD Bullish: Confirm with GBP/USD and AUD/USD strength

- USD/JPY Bearish: Check USD weakness in EUR/USD and GBP/USD

- Commodity Currencies: AUD/USD, NZD/USD, USD/CAD often move together

Trading Strategies Using Correlations

Strategy 1: The Pair Trade

Concept: Trade the spread between two correlated pairs.

Example - EUR/GBP Spread Trade:

- Setup: EUR/USD and GBP/USD have 0.85 correlation

- Signal: EUR/USD strengthens more than GBP/USD

- Action: Buy EUR/GBP (long EUR, short GBP)

- Exit: When correlation normalizes or mean reverts

Risk Management:

- Set stops based on divergence limits

- Monitor correlation strength changes

- Close positions if correlation breaks down

Strategy 2: Currency Rotation

Concept: Rotate between different currency pairs based on correlation changes.

Example - USD Strength Rotation:

- Initial: Long EUR/USD (long EUR, short USD)

- Signal: USD starts strengthening broadly

- Action: Close EUR/USD, open USD/CAD and USD/CHF longs

- Rationale: Maintain USD short exposure through different channels

Strategy 3: Correlation Breakout

Concept: Trade when historical correlations break down.

Example - AUD/CAD Divergence:

- Setup: AUD and CAD normally track commodity prices similarly

- Signal: AUD strengthens while CAD weakens despite similar fundamentals

- Action: Long AUD/CAD expecting correlation to normalize

- Exit: When correlation returns to historical norms

Calculating and Monitoring Correlations

How to Calculate Correlation

Where x and y are the price changes of the two currency pairs.

Correlation Calculation Example

Sample 5-Day Correlation Calculation

| Day | EUR/USD Change | GBP/USD Change | Product (x×y) |

|---|---|---|---|

| 1 | +0.50% | +0.45% | +0.225% |

| 2 | -0.30% | -0.25% | +0.075% |

| 3 | +0.80% | +0.70% | +0.560% |

| 4 | -0.20% | -0.15% | +0.030% |

| 5 | +0.40% | +0.35% | +0.140% |

| Sum | +1.030% | ||

Result: Strong positive correlation (+0.95)

Tools for Monitoring Correlations

Free Tools

- MyFxBook Correlation: Free correlation calculator

- TradingView Correlation: Built-in correlation indicators

- Oanda Correlation: Interactive correlation matrix

- Excel/Spreadsheets: Calculate with CORREL function

Professional Tools

- Bloomberg Terminal: Advanced correlation analysis

- Reuters Eikon: Professional correlation data

- MultiCharts: Custom correlation indicators

- MetaTrader Add-ons: Correlation Expert Advisors

Correlation Timeframes

| Timeframe | Correlation Strength | Reliability | Best Use |

|---|---|---|---|

| 1-Minute | Highly Variable | Low | Scalping confirmation |

| 5-Minute | Moderate | Low-Medium | Intraday trading |

| 1-Hour | Good | Medium | Day trading |

| 4-Hour | Strong | Medium-High | Swing trading |

| Daily | Very Strong | High | Position trading |

| Weekly | Extremely Strong | Very High | Long-term analysis |

Common Correlation Mistakes

- Assuming correlations are static: Correlations change over time and can break down suddenly

- Using outdated correlation data: Always check current correlations, not historical assumptions

- Ignoring timeframes: Short-term correlations differ from long-term correlations

- Over-hedging: Too much hedging can eliminate profit potential

- Correlation vs. Causation: Correlated pairs don't necessarily have causal relationships

- Ignoring volatility: Correlations can change during high volatility periods

Major Currency Groups and Their Correlations

1. The Dollar Block (USD Majors)

USD Majors Correlation Matrix

| Pair | EUR/USD | GBP/USD | USD/JPY | AUD/USD |

|---|---|---|---|---|

| EUR/USD | 1.00 | +0.85 | -0.75 | +0.70 |

| GBP/USD | +0.85 | 1.00 | -0.65 | +0.75 |

| USD/JPY | -0.75 | -0.65 | 1.00 | -0.60 |

| AUD/USD | +0.70 | +0.75 | -0.60 | 1.00 |

2. Commodity Currencies

AUD, NZD, CAD often move together due to:

- Similar commodity exposure (gold, oil, agricultural products)

- Similar interest rate cycles

- Risk-on/risk-off sentiment sensitivity

3. European Currencies

EUR and related currencies (CHF, SEK, NOK) often correlate due to:

- EU economic integration

- ECB policy influence

- Similar business cycles

Advanced Correlation Concepts

1. Rolling Correlations

Correlations calculated over rolling windows (e.g., 30-day rolling correlation) show how relationships evolve over time.

2. Conditional Correlations

Correlations that change based on market conditions:

- Crisis correlations: Often increase during market stress

- Volatility correlations: Change with market volatility levels

- Trend correlations: May differ between trending and ranging markets

3. Cross-Asset Correlations

Currency correlations with other asset classes:

- USD and Gold: Typically negative correlation (-0.4 to -0.6)

- Risk currencies and Stock indices: Positive correlation during risk-on periods

- Oil and CAD: Strong positive correlation due to oil exports

Building a Correlation-Aware Trading Plan

Step 1: Portfolio Analysis

- List all open and planned positions

- Calculate net exposure to each currency

- Identify correlated positions

- Assess total risk concentration

Step 2: Risk Management Rules

- Set maximum exposure limits per currency

- Establish correlation-based position sizing rules

- Create rules for closing correlated positions

- Monitor correlation changes actively

Step 3: Trade Selection

- Use correlations to find trade confirmations

- Avoid trades that create excessive correlation risk

- Consider correlation when setting stop losses

- Plan exits based on correlation breakdown

Conclusion

Currency correlation is a powerful tool that separates amateur traders from professionals. While most retail traders focus on individual pairs in isolation, successful traders understand how the forex market is interconnected and use that knowledge to manage risk and identify opportunities.

Mastering currency correlation requires:

- Understanding the mathematical relationship between pairs

- Recognizing why correlations exist and when they might change

- Using correlations for risk management rather than prediction

- Monitoring correlation changes actively

- Applying correlation knowledge to position sizing and hedging

Remember that correlations are tools, not rules. They help you understand market relationships and manage risk, but they don't guarantee future performance. The best approach is to use correlation analysis to inform your trading decisions while maintaining awareness of the underlying fundamentals that drive currency values.

No comments