💪 Forex Trading Mistakes Recovery

Bounce Back from Losses Like a Pro

Learn proven strategies for recovering from forex trading mistakes and losses. Discover psychological techniques, practical steps, and proven methods to rebuild confidence, return to profitability, and emerge stronger from setbacks.

📋 Table of Contents

- Understanding Trading Losses

- Top 10 Trading Mistakes & Recovery

- Psychological Recovery Process

- Practical Recovery Steps

- Rebuilding Trading Confidence

- Strategy Revision & Improvement

- Risk Management Rehabilitation

- The Comeback Timeline

- Recovery Success Stories

- Preventing Future Mistakes

- Your Recovery Action Plan

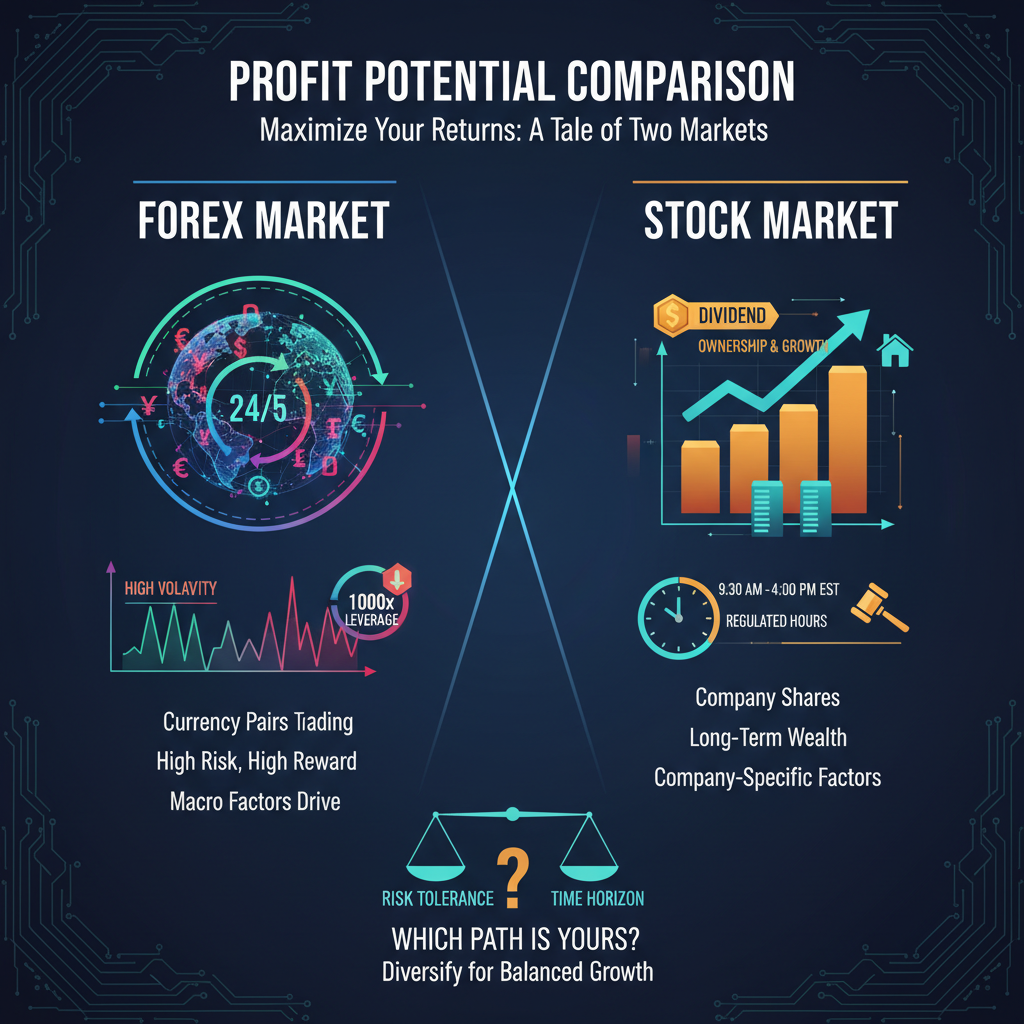

🔍 Understanding Trading Losses

Losses are an inevitable part of forex trading, but how you handle them determines your long-term success. Understanding the different types of losses and their psychological impact is crucial for effective recovery.

of traders experience significant losses in first year

months average recovery time from major losses

of traders who recover use systematic approach

stronger traders become after recovery

📊 Types of Trading Losses

- Expected Losses: Normal part of profitable trading (stop losses, normal drawdowns)

- Execution Errors: Technical mistakes in order placement or management

- Strategy Failures: When trading approaches stop working effectively

- Emotional Mistakes: Trading driven by fear, greed, or overconfidence

- External Events: Unexpected market shocks and black swan events

🧠 Psychology of Losses

- Fear of Re-entry: Reluctance to trade after losses

- Revenge Trading: Making larger trades to "win back" losses

- Analysis Paralysis: Over-thinking and avoiding trades

- Loss Aversion: Taking profits too early, holding losers too long

- Overconfidence: Increasing risk after initial recovery

🚫 Top 10 Trading Mistakes & Recovery

Every trader makes mistakes, but successful traders learn to recover from them systematically. Here are the most common mistakes and how to recover from each.

What Happened: You used excessive margin, leading to margin calls or large losses that threatened your account survival.

Recovery Strategy:

- Immediate: Reduce leverage to 10:1 maximum until account stabilizes

- Week 1-2: Trade micro lots only (0.01) for 2 weeks minimum

- Month 1: Focus on position sizing education and risk management

- Long-term: Implement strict leverage limits in trading plan

Prevention: Never risk more than 2% per trade, always use stop losses

What Happened: After a losing trade, you made larger or riskier trades to "get even" quickly.

Recovery Strategy:

- Immediate: Take a 24-48 hour trading break

- Week 1: Journal all emotional triggers and recovery thoughts

- Week 2-4: Practice breathing techniques and pre-trade rituals

- Ongoing: Develop strict "one trade at a time" policy

Prevention: Set daily loss limits, implement cooling-off periods

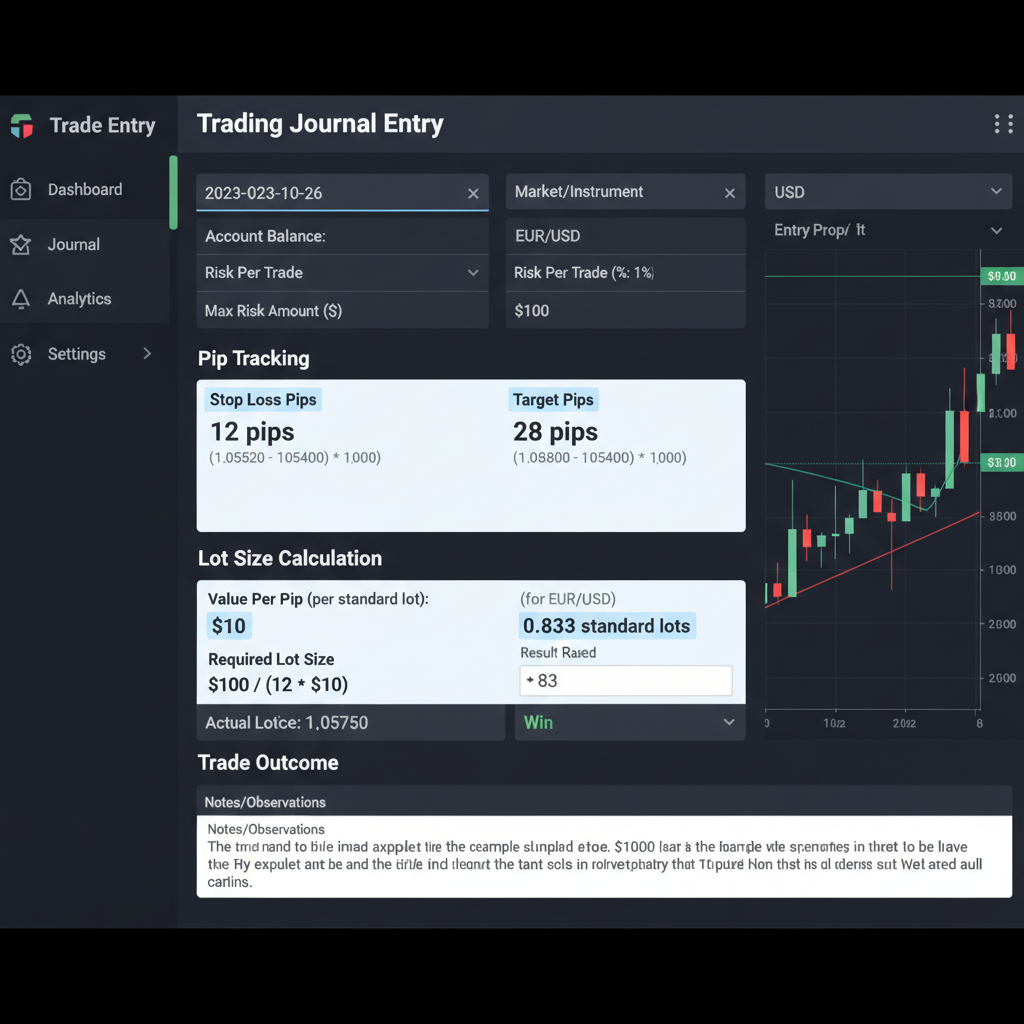

What Happened: You traded without stop losses, proper position sizing, or risk rules.

Recovery Strategy:

- Week 1: Study risk management fundamentals thoroughly

- Week 2-3: Create detailed risk management rules and templates

- Week 4-8: Practice risk calculations on demo before live trading

- Month 3+: Implement automated risk controls in trading platform

Prevention: Use platform alerts, automated stops, risk management software

What Happened: You constantly changed trading strategies instead of mastering one approach.

Recovery Strategy:

- Month 1: Analyze all previous strategies and identify what didn't work

- Month 2: Select one primary strategy and commit to it for 6 months

- Months 3-6: Master the chosen strategy through focused practice

- Month 6+: Consider adding complementary strategies only after mastery

Prevention: Set minimum timeframe commitments before strategy changes

What Happened: You made trades based on gut feelings or "hunches" rather than systematic analysis.

Recovery Strategy:

- Week 1-2: Write comprehensive trading plan with all rules

- Week 3-4: Create trade checklists and pre-trade procedures

- Month 2: Practice following plan on demo for consistency

- Month 3+: Strictly follow plan for all live trades

Prevention: Review trading plan weekly, update as needed

🧠 Psychological Recovery Process

Physical losses in forex are only half the challenge. The psychological impact of losses can be more damaging and longer-lasting. Here's how to recover mentally.

🧘 Emotional Recovery Techniques

Accept that losses are part of trading and spend time processing the emotions. Don't suppress or ignore them—acknowledge and work through them.

View losses as learning experiences rather than failures. Ask "What can I learn?" instead of "Why did this happen to me?"

Don't jump back into trading immediately. Gradually reintroduce yourself to the markets through analysis and small, low-pressure trades.

Surround yourself with positive influences—trading mentors, supportive friends, or professional counselors if needed.

📊 Recovery Phase Timeline

| Phase | Duration | Focus | Activities | Success Indicators |

|---|---|---|---|---|

| Shock & Denial | 1-3 days | Emotional processing | Rest, reflection, avoid trading | Can discuss loss calmly |

| Anger & Blame | 3-7 days | Emotion management | Journaling, talking, exercise | Less anger, more understanding |

| Analysis & Planning | 1-2 weeks | Learning extraction | Review trades, plan recovery | Clear action plan developed |

| Preparation | 2-4 weeks | Skill rebuilding | Education, demo trading | Confident in plan |

| Gradual Return | 1-3 months | Controlled trading | Small live trades, monitoring | Consistent performance |

⚡ Practical Recovery Steps

Follow this systematic approach to recover from trading losses and return to profitability.

🎯 Phase 1: Stop and Assess (Days 1-7)

- Stop all trading immediately

- Calculate exact losses and current account status

- Identify root causes of losses

- Take emotional inventory and seek support if needed

- Rest and avoid market-related stress

🎯 Phase 2: Analyze and Learn (Week 2-3)

- Review all trades leading to losses

- Identify patterns in mistakes and bad decisions

- Study fundamental and technical analysis gaps

- Research successful traders' recovery stories

- Create detailed improvement plan

🎯 Phase 3: Rebuild Foundation (Month 1)

- Complete risk management education

- Develop new or improved trading plan

- Set up proper trading infrastructure

- Practice on demo accounts extensively

- Build confidence through consistent practice

🎯 Phase 4: Gradual Return (Months 2-3)

- Start with very small position sizes

- Focus on process over profits

- Trade only high-probability setups

- Maintain detailed trading journal

- Celebrate small wins and progress

🎯 Phase 5: Full Recovery (Months 4-6)

- Gradually increase position sizes

- Expand to full trading schedule

- Implement learned improvements

- Monitor psychology and emotional responses

- Return to normal trading parameters

💪 Rebuilding Trading Confidence

Confidence is crucial for successful trading, and it must be rebuilt systematically after significant losses.

🏗️ Confidence Building Framework

📈 Confidence Rebuilding Timeline

✅ Confidence Building Activities

- Success Visualization: Regularly visualize successful trades and positive outcomes

- Achievement Journaling: Document every small win and improvement

- Skill Development: Continuously improve technical and fundamental analysis skills

- Mentor Support: Work with experienced traders or coaches

- Positive Affirmations: Use positive self-talk and affirmations daily

- Community Participation: Join supportive trader communities and forums

🔧 Strategy Revision & Improvement

After losses, it's important to analyze and improve your trading strategies to prevent similar mistakes in the future.

📊 Strategy Audit Process

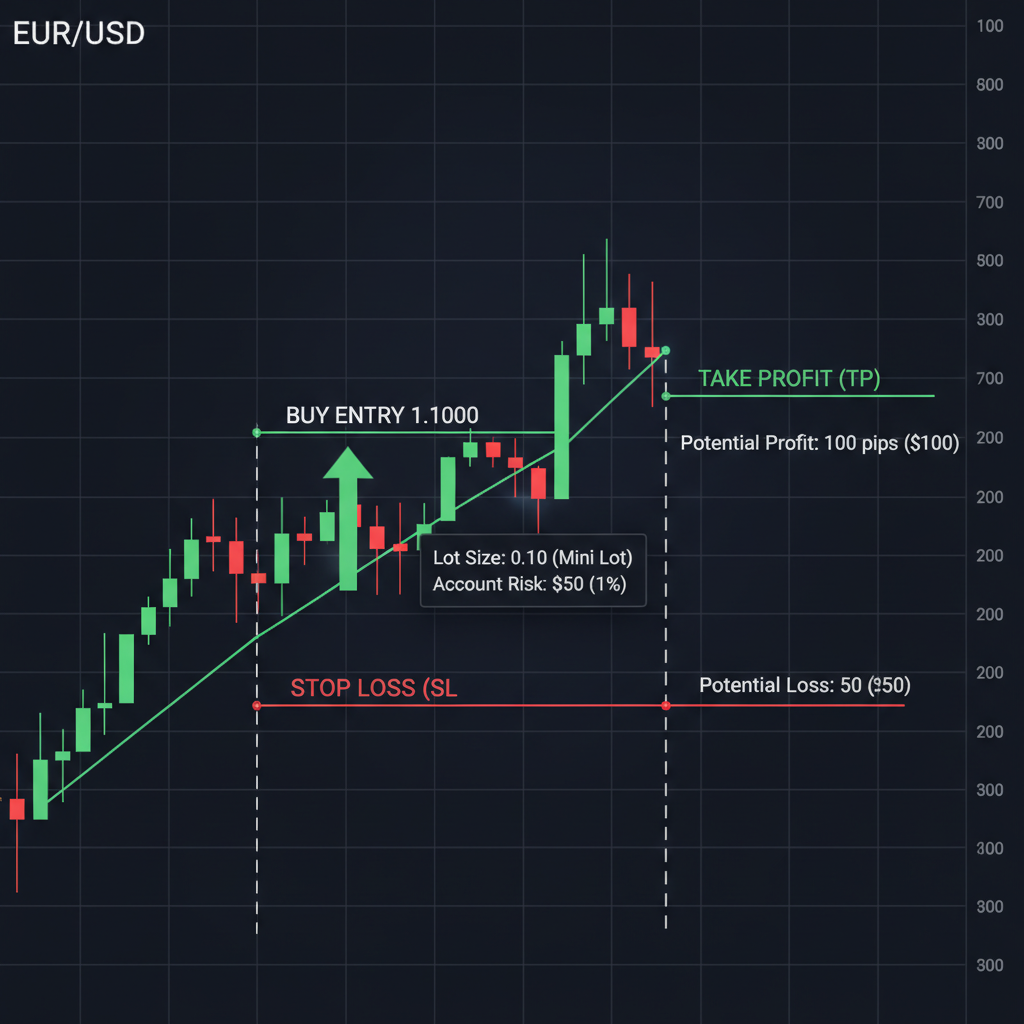

- Entry Criteria: Are your entry rules clear and tested?

- Exit Rules: Do you have predetermined stop loss and take profit levels?

- Risk Management: Are position sizing rules appropriate for your account?

- Market Conditions: Does your strategy work in current market environments?

- Time Commitment: Can you properly execute the strategy with your available time?

- Stress Level: Does the strategy cause excessive stress or anxiety?

🔄 Strategy Improvement Areas

| Area | Common Issues | Improvement Methods | Testing Approach |

|---|---|---|---|

| Entry Timing | Poor entry points, late entries | Better indicator combinations | Backtest entry timing accuracy |

| Risk Management | Inappropriate position sizing | Standardized risk formulas | Calculate risk per trade systematically |

| Market Selection | Trading wrong pairs/times | Focus on best-performing pairs | Track performance by pair and time |

| Psychology | Emotional decision making | Systematic rules and checklists | Journal emotional responses |

🛡️ Risk Management Rehabilitation

Re-establishing proper risk management is crucial for preventing future losses and building trading sustainability.

- Assessment: Calculate current risk exposure and account vulnerability

- Reduction: Immediately reduce all risk parameters to safe levels

- Education: Study risk management principles thoroughly

- Implementation: Create and follow strict risk management rules

- Monitoring: Continuously track and adjust risk parameters

📋 New Risk Management Rules

- Maximum Risk: Never risk more than 1% per trade during recovery

- Daily Limits: Maximum daily loss of 3% of account

- Weekly Limits: Stop trading if weekly loss exceeds 5%

- Position Limits: Maximum 2 open positions simultaneously

- Correlation Limits: Avoid correlated positions

- Review Requirements: Mandatory review after any 3% drawdown

📅 The Comeback Timeline

Recovery takes time, and setting realistic expectations helps maintain motivation throughout the process.

⏰ Recovery Expectations

Initial emotional recovery period

Return to consistent demo trading

Return to normal live trading

Full confidence and performance recovery

🎯 Milestone Celebrations

- Day 7: Completed initial analysis and created recovery plan

- Day 30: Finished risk management education and demo consistency

- Day 60: First profitable week back in live trading

- Day 90: Achieved 3 consecutive profitable weeks

- Day 180: Returned to pre-loss account value

- Day 365: Exceeded previous peak performance

📈 Recovery Success Stories

Learning from others who have successfully recovered from significant trading losses can provide hope and practical insights.

🌟 Recovery Story: From $50K Loss to Millionaire

The Loss: Sarah, a retail trader, lost $50,000 over 6 months through overleveraging and poor risk management.

The Recovery:

- Months 1-2: Stopped trading, studied risk management, opened new demo account

- Months 3-4: Built new conservative strategy, practiced on demo for 3 months

- Months 5-8: Returned to live trading with $5,000 and strict risk management

- Months 9-18: Gradually scaled account to $100,000 through consistent profits

- Years 2-5: Grew account to over $1 million using disciplined approach

Key Lesson: "The biggest gain from my loss was learning that slow and steady wins the race. My recovery took longer than my loss, but I'm now a much better trader."

🌟 Recovery Story: Bouncing Back from Margin Call

The Loss: Mike experienced a margin call that wiped out his $25,000 account.

The Recovery:

- Week 1: Took time to process emotions and analyze mistakes

- Month 1: Started with $2,000 in new account, micro lots only

- Months 2-6: Focused on education, demo trading, and psychology

- Year 1: Built account to $25,000 with consistent monthly profits

- Years 2-3: Scaled to $100,000+ with advanced strategies

Key Lesson: "Margin calls teach you humility. I learned to respect the market and never use excessive leverage again."

🛡️ Preventing Future Mistakes

Once you've recovered, the focus shifts to preventing similar mistakes in the future.

🔒 Prevention Systems

- Written Rules: Create detailed trading rules and review them regularly

- System Checks: Implement automated checks for risk limits

- Accountability: Share your plan with others who can monitor your adherence

- Regular Reviews: Weekly and monthly performance reviews

- Continuous Learning: Ongoing education and skill development

- Emergency Protocols: Predefined actions for different loss scenarios

📋 Warning Signs

- Increasing position sizes after consecutive wins

- Skipping analysis or taking trades "on gut feeling"

- Ignoring stop losses or moving them further away

- Revenge trading after losses

- Neglecting risk management rules

- Overconfidence leading to careless decisions

🎯 Your Recovery Action Plan

Here's your personalized action plan to recover from trading mistakes and return to profitability.

📋 Immediate Actions (First 7 Days)

- Stop Trading: No live trades until recovery plan is complete

- Calculate Losses: Determine exact financial impact and account status

- Emotional Assessment: Identify your emotional state and seek support if needed

- Root Cause Analysis: Identify what led to the losses

- Create Recovery Timeline: Set realistic recovery expectations

- Financial Assessment: Ensure you can afford to continue trading

- Rest and Recover: Take time away from trading screens

📅 30-Day Recovery Plan

🗓️ Month 1 Recovery Schedule:

🚀 90-Day Comeback Plan

| Month | Primary Focus | Key Activities | Success Metrics |

|---|---|---|---|

| Month 1 | Recovery & Analysis | Education, planning, demo practice | Completed analysis and plan |

| Month 2 | Demo Consistency | Consistent demo trading, rule following | 20+ demo trades with 60%+ win rate |

| Month 3 | Live Return | Small live trades, strict risk management | First profitable week in live trading |

📚 Conclusion

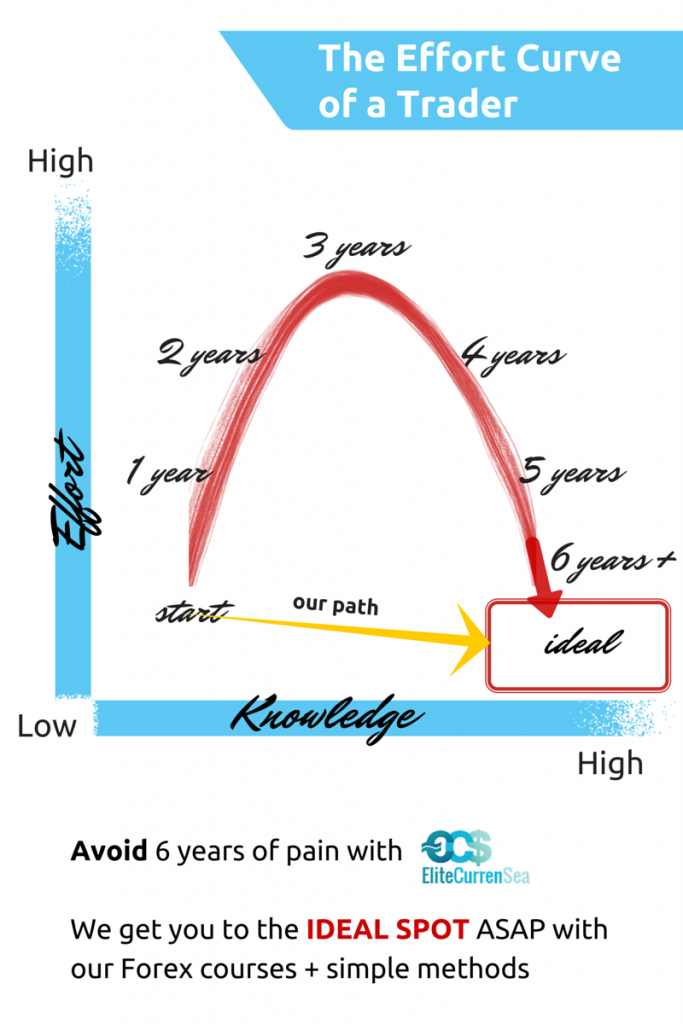

Recovering from forex trading mistakes is challenging but achievable with the right approach, mindset, and timeline. The most important aspect is to view recovery as an opportunity to become a better, more disciplined trader rather than just trying to get back to where you were.

• Recovery takes time - don't rush back into trading

• Focus on process, not profits - good decisions lead to good outcomes

• Risk management first - protect your capital above all else

• Learn from mistakes - every loss contains valuable lessons

• Build support systems - you don't have to recover alone

Remember that some of the most successful traders in history have experienced major losses and made spectacular comebacks. Your current setback is not your final destination—it's a stepping stone to becoming a better trader. With patience, discipline, and systematic recovery, you can not only recover from your losses but emerge stronger and more profitable than ever before.

You've reached the end of our comprehensive 50-article forex trading course. You now have all the knowledge needed to become a successful forex trader. Remember: success in forex trading is a journey, not a destination.

🏆 You've Completed the Ultimate Forex Course!

50 comprehensive articles covering everything from basics to advanced strategies.

Your journey to forex trading success starts now!

No comments