🤖 Forex Robots Introduction

Your Complete Guide to Automated Trading Systems

This comprehensive guide will introduce you to the world of forex robots and Expert Advisors (EAs). You'll discover how automated trading systems work, their benefits and limitations, and learn how to choose the right EA for your trading strategy. Whether you're a beginner or experienced trader, this article will help you understand the fundamentals of forex automation.

📋 Table of Contents

- What Are Forex Robots?

- How Do Forex Robots Work?

- Types of Forex Robots

- Advantages and Disadvantages

- Choosing the Right Forex Robot

- Setting Up Your First EA

- Best Practices for EA Trading

- Common Mistakes to Avoid

- The Future of Forex Robots

- Frequently Asked Questions

🤖 What Are Forex Robots?

Forex robots, also known as Expert Advisors (EAs) or automated trading systems, are computer programs designed to execute trades in the foreign exchange market automatically based on pre-programmed rules and algorithms.

A Forex Robot is a software application that can analyze market conditions, make trading decisions, and execute trades automatically without human intervention. These systems are designed to follow specific trading strategies consistently and objectively.

🔍 What Makes Forex Robots Different?

Unlike manual trading, where human emotions and psychology play a significant role, forex robots operate based purely on mathematical algorithms and predefined rules. This eliminates:

- Emotional Decision Making - No fear, greed, or overconfidence

- Human Fatigue - Can trade 24/7 without breaks

- Inconsistent Execution - Same rules applied every time

- Time Limitations - Can monitor multiple currency pairs simultaneously

📊 Market Statistics

of forex traders use some form of automated trading

billion daily volume handled by automated systems

different forex robots available in the market

reduction in human error with automated trading

⚙️ How Do Forex Robots Work?

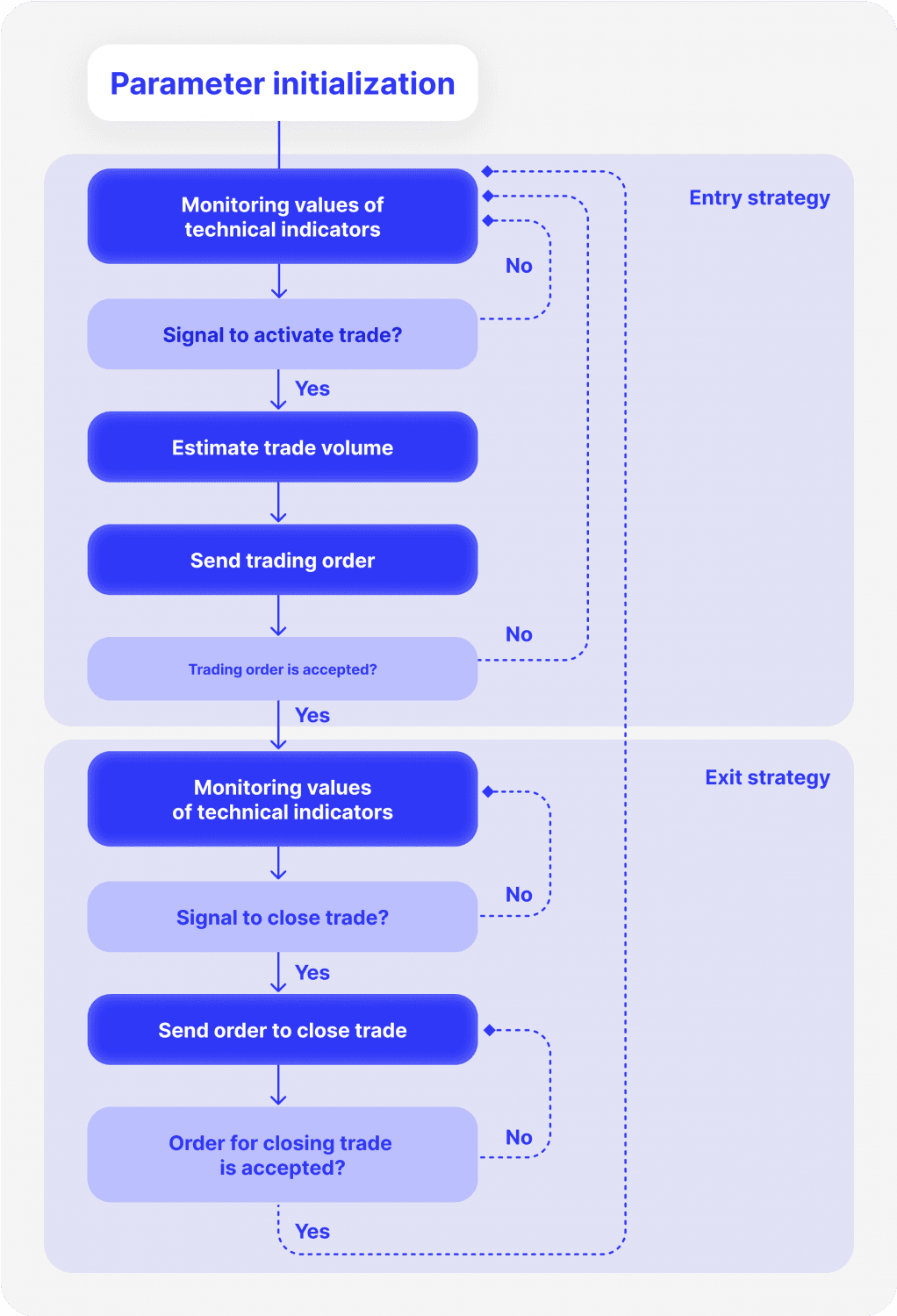

Forex robots operate through a systematic process that involves market analysis, signal generation, and trade execution. Understanding this workflow is crucial for anyone considering automated trading.

🔄 The 4-Step Process

- Market Analysis: Continuously monitor price movements, technical indicators, and economic news

- Signal Generation: Apply programmed logic to identify trading opportunities

- Risk Assessment: Evaluate position sizing, stop loss, and take profit levels

- Trade Execution: Place orders automatically when conditions are met

📈 Technical Analysis Components

Most forex robots rely on technical analysis indicators to make trading decisions. Common indicators include:

| Indicator Type | Examples | Purpose | Usage in EAs |

|---|---|---|---|

| Trend Following | Moving Averages, MACD, ADX | Identify market direction | Primary signals for trend-based strategies |

| Momentum | RSI, Stochastic, Williams %R | Measure price velocity | Entry/exit timing optimization |

| Volatility | Bollinger Bands, ATR | Assess market conditions | Dynamic stop-loss and take-profit |

| Volume | Volume indicators, Volume Profile | Confirm price movements | Filter false signals |

🧠 Algorithmic Logic

The core of any forex robot is its algorithmic logic, which determines how it interprets market data and makes decisions. Common logical structures include:

- If-Then Conditions: "IF RSI < 30 AND price touches support, THEN buy"

- Boolean Logic: Combining multiple conditions with AND/OR operators

- Mathematical Calculations: Position sizing based on account balance and risk percentage

- Pattern Recognition: Identifying recurring price patterns in historical data

- Machine Learning: Some advanced EAs use AI to adapt to changing market conditions

📚 Types of Forex Robots

Forex robots come in various types, each designed for different trading styles, market conditions, and risk profiles. Understanding these categories helps you choose the right EA for your needs.

📊 Classification by Trading Strategy

🎯 Scalping Robots

These robots are designed for high-frequency trading, making numerous small profits from minor price movements.

- Timeframe: M1-M5 charts

- Trade Duration: Seconds to minutes

- Profit Target: 1-5 pips per trade

- Risk Level: Medium to High

- Best Markets: London/New York overlap, liquid pairs

📈 Trend Following Robots

These EAs identify and ride major market trends, aiming for larger moves over extended periods.

- Timeframe: H1-H4 charts

- Trade Duration: Hours to days

- Profit Target: 20-100+ pips per trade

- Risk Level: Low to Medium

- Best Markets: Strong trending pairs during major sessions

🔄 Grid Trading Robots

These robots place orders at regular intervals, creating a "grid" to profit from market volatility.

- Timeframe: M15-H1 charts

- Trade Duration: Variable (hours to weeks)

- Profit Target: Multiple small profits

- Risk Level: High (drawdown potential)

- Best Markets: Ranging markets with clear support/resistance

⚡ News Trading Robots

Specialized EAs that capitalize on volatility around major economic news releases.

- Timeframe: M1-M15 charts

- Trade Duration: Minutes to hours

- Profit Target: 10-50+ pips from volatility

- Risk Level: Very High

- Best Markets: NFP, FOMC, ECB announcements

🏗️ Classification by Complexity Level

| Complexity Level | Features | Price Range | Best For |

|---|---|---|---|

| Basic EAs | Simple indicators, basic logic | Free - $100 | Beginners, learning purposes |

| Intermediate EAs | Multiple indicators, money management | $100 - $500 | Regular traders, moderate complexity |

| Advanced EAs | AI, multi-timeframe, adaptive logic | $500 - $2000+ | Professional traders, institutional use |

| Custom EAs | Tailored to specific strategies | $2000+ | High-net-worth individuals, funds |

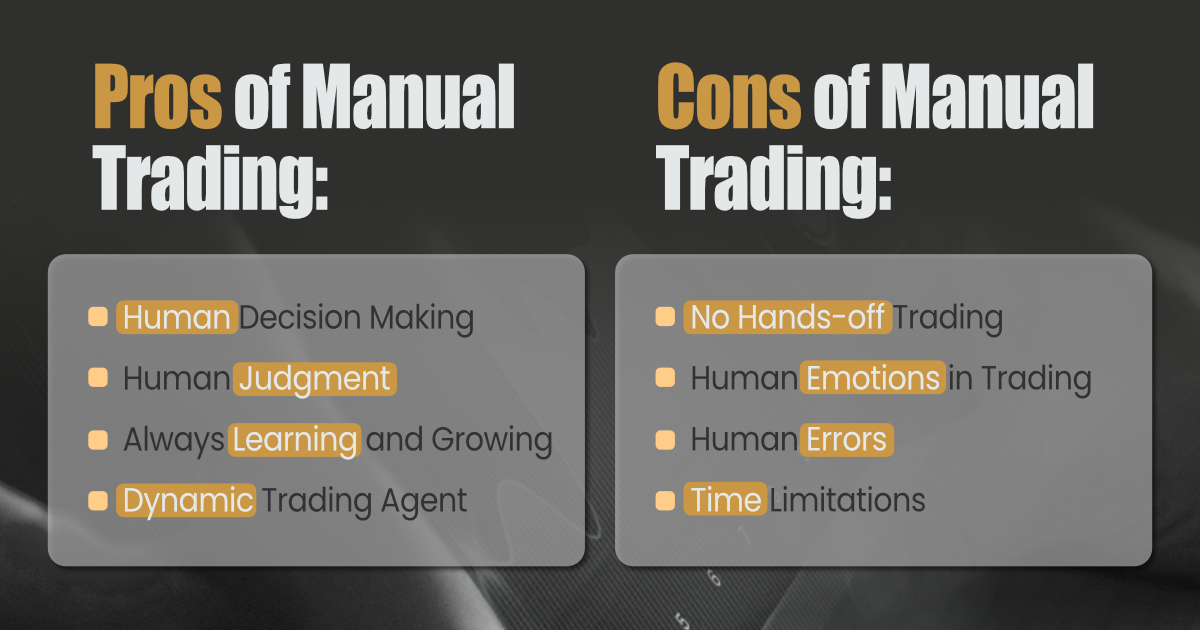

⚖️ Advantages and Disadvantages

Like any trading approach, forex robots have both significant advantages and notable drawbacks. Understanding these helps you make informed decisions about automated trading.

✅ Advantages

- 24/7 Market Monitoring: Never miss trading opportunities

- Emotion-Free Trading: No fear, greed, or hesitation

- Consistent Execution: Same rules applied every time

- Multi-Pair Trading: Monitor dozens of currencies simultaneously

- Backtesting Capability: Test strategies on historical data

- Risk Management: Precise position sizing and stop losses

- Speed: Instant order execution, no delays

- Discipline: Follows trading plan exactly

- Time Efficiency: Free up time for other activities

- Back-to-Back Trading: Can trade multiple sessions

❌ Disadvantages

- Market Adaptability: May struggle with sudden changes

- Technology Dependence: Requires stable internet and power

- Over-Optimization: Risk of curve-fitting to past data

- Black Swan Events: Cannot handle unprecedented events

- Maintenance Required: Need regular updates and monitoring

- Initial Setup Complexity: Steep learning curve for beginners

- Vendor Risk: Dependence on third-party developers

- Lack of Intuition: Cannot interpret subtle market nuances

- False Signals: May generate many losing trades

- Capital Requirements: Often require larger accounts

While forex robots offer many advantages, they are not "set and forget" solutions. Successful automated trading requires regular monitoring, periodic optimization, and ongoing education about market conditions.

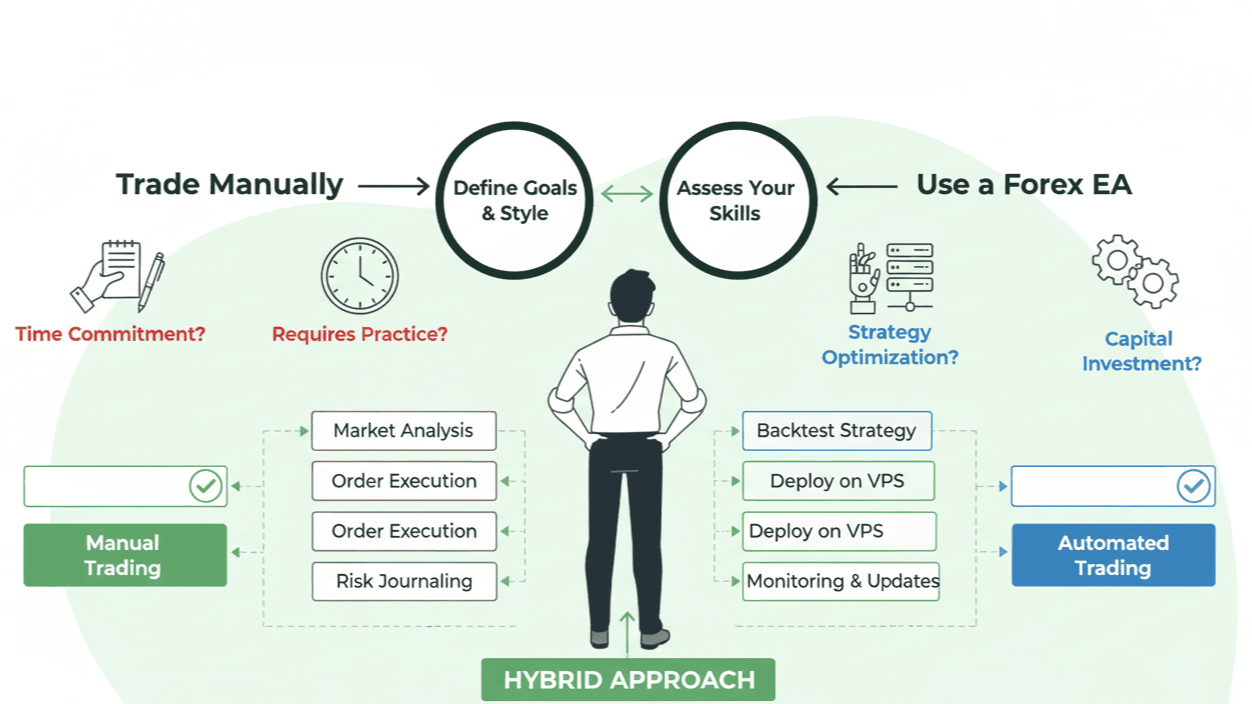

🎯 Choosing the Right Forex Robot

Selecting the right forex robot is crucial for your trading success. The decision should be based on your trading experience, risk tolerance, capital amount, and market goals.

🔍 Key Evaluation Criteria

- Backtesting Results: Historical performance over multiple market conditions

- Forward Testing: Live trading results on demo accounts

- Risk Management: Built-in protection mechanisms

- Transparency: Clear strategy logic and vendor track record

- Support & Updates: Ongoing maintenance and customer service

📊 Essential Metrics to Evaluate

| Metric | What It Measures | Good Range | Red Flag |

|---|---|---|---|

| Win Rate | Percentage of profitable trades | 55-75% | < 45% or > 90% |

| Maximum Drawdown | Largest losing streak | < 20% | > 50% |

| Risk-Reward Ratio | Average profit vs. loss | 1.5:1 minimum | < 1:1 |

| Sharpe Ratio | Risk-adjusted returns | > 1.0 | < 0.5 |

| Profit Factor | Gross profit / gross loss | > 1.5 | < 1.2 |

💰 Budget Considerations

Your budget significantly impacts your EA choices and should be aligned with your risk management principles.

Minimum recommended account for EA trading

Typical EA purchase price range

Recommended risk per trade

Monthly EA maintenance costs

🎯 Matching EAs to Trader Profiles

👤 Beginner Traders

- Recommended Features: Simple strategy, clear documentation, tutorial videos

- Risk Level: Conservative, low drawdown

- Budget Range: Free to $200

- Example Types: Trend following, moving average crossover

📈 Intermediate Traders

- Recommended Features: Multiple indicators, money management, optimization options

- Risk Level: Moderate, balanced approach

- Budget Range: $200-$800

- Example Types: Scalping with filters, breakout strategies

🏆 Advanced Traders

- Recommended Features: AI integration, multi-timeframe, custom parameters

- Risk Level: Aggressive, higher returns potential

- Budget Range: $800-$2000+

- Example Types: News trading, complex grid systems

⚙️ Setting Up Your First EA

Setting up your first forex robot involves several technical and strategic steps. Proper installation and configuration are essential for optimal performance.

🛠️ Technical Requirements

- Trading Platform: MetaTrader 4 or MetaTrader 5

- VPS (Recommended): 24/7 uptime for uninterrupted trading

- Internet Connection: Stable, high-speed connection

- Computer/VPS Specs: Windows 10/11, 4GB RAM minimum

- Backup Power: UPS or VPS redundancy

📥 Installation Process

- Download the EA file (usually .ex4 or .ex5 format)

- Open MetaTrader and navigate to File → Open Data Folder

- Copy the EA file to MQL4 → Experts (for MT4) or MQL5 → Experts (for MT5)

- Restart MetaTrader to load the new EA

- Check Navigator panel to confirm the EA appears in Expert Advisors

⚙️ Configuration Parameters

Most EAs come with configurable parameters that control various aspects of trading behavior.

| Parameter Type | Common Settings | Purpose | Adjustment Guide |

|---|---|---|---|

| Lot Size | 0.01, 0.1, 1.0 | Position sizing | Adjust based on account balance |

| Take Profit | 10-100 pips | Profit target | Match to strategy timeframe |

| Stop Loss | 5-50 pips | Risk management | Set based on volatility |

| Magic Number | Unique identifier | Track EA trades | Use different numbers for multiple EAs |

| Trading Hours | Session-specific | Time filtering | Match to optimal market hours |

🎛️ Recommended Initial Settings

- Lot Size: 0.01 (micro lot) - Start small

- Risk Percentage: 1-2% per trade - Preserve capital

- Max Simultaneous Trades: 1-3 - Reduce exposure

- Stop Loss: 20-30 pips - Allow for normal volatility

- Take Profit: 40-60 pips - 2:1 risk-reward ratio

- Trading Hours: London/New York sessions only

📋 Best Practices for EA Trading

Following proven best practices significantly increases your chances of success with automated trading systems.

🎯 Strategic Best Practices

- Start with Demo Trading: Test thoroughly before risking real money

- Begin with Small Position Sizes: Use 0.01 lots initially

- Monitor Performance Regularly: Check EA performance daily

- Keep Trading Journal: Document all EA trades and results

- Don't Over-Optimize: Avoid excessive parameter tweaking

- Use Proper Money Management: Never risk more than 2% per trade

- Regular Backups: Save EA settings and trading history

- Stay Updated: Keep EA software and platform updated

🛡️ Risk Management Principles

Effective risk management is crucial for long-term success with forex robots.

💰 Position Sizing Rules

- Conservative: 0.5-1% risk per trade

- Moderate: 1-2% risk per trade

- Aggressive: 2-3% risk per trade

- Never exceed: 5% risk per trade under any circumstances

📊 Drawdown Management

- Alert Level: 10% drawdown - Review strategy

- Caution Level: 15% drawdown - Reduce position sizes

- Stop Trading: 20% drawdown - Pause and analyze

- Emergency Exit: 25% drawdown - Close all positions

🔍 Performance Monitoring

Regular monitoring helps identify issues early and optimize EA performance.

| Frequency | What to Check | Key Metrics | Action if Issues Found |

|---|---|---|---|

| Daily | Open positions, recent trades | Win/loss ratio, P&L | Adjust if inconsistent with expectations |

| Weekly | Overall performance, drawdown | Weekly return, max drawdown | Review if underperforming benchmark |

| Monthly | Strategy effectiveness, market conditions | Monthly return, Sharpe ratio | Consider optimization or strategy change |

| Quarterly | Long-term viability, market adaptation | Cumulative return, consistency | Major review and potential EA replacement |

🚫 Common Mistakes to Avoid

Avoiding common pitfalls is as important as following best practices. Learn from others' mistakes to improve your automated trading success.

❌ Top 10 EA Trading Mistakes

- Buying EAs Based on Marketing Claims: Always verify with independent backtests

- Set-and-Forget Mentality: EAs require regular monitoring and maintenance

- Over-Optimizing Parameters: Curve-fitting leads to poor live performance

- Insufficient Testing: Demo testing for at least 3-6 months recommended

- Poor Risk Management: Risking too much capital per trade

- Ignoring Market Conditions: EAs may need adjustment for different market phases

- Not Using VPS: Internet outages can cause missed trades or losses

- Trading Too Many Pairs: Start with 1-3 currency pairs to master

- Emotional Interference: Don't manually override EA decisions frequently

- Neglecting Regular Updates: Markets change, EAs need periodic updates

💸 Financial Mistakes

- Undercapitalized Trading: Starting with insufficient funds

- High Commission Brokers: Excessive spreads and fees reduce profits

- No Emergency Fund: Keeping all capital in trading account

- Reinvesting All Profits: Not taking regular withdrawals

- No Profit Targets: Not having specific financial goals

🛠️ Technical Mistakes

- Poor Internet Connection: Unstable connectivity causes trade errors

- Outdated Software: Using old EA versions with known bugs

- Multiple EAs on Same Pair: Conflicting signals and overtrading

- No Backup Plan: No contingency for EA failure or broker issues

- Inadequate Testing: Insufficient forward testing before live trading

🚀 The Future of Forex Robots

The forex robot industry continues to evolve rapidly with technological advances. Understanding future trends helps you stay ahead of the curve.

🤖 Emerging Technologies

🧠 Artificial Intelligence Integration

Next-generation EAs are incorporating machine learning and AI to adapt to changing market conditions:

- Adaptive Algorithms: EAs that learn and adjust to market changes

- Pattern Recognition: AI-powered identification of complex market patterns

- Natural Language Processing: Integration of news sentiment analysis

- Deep Learning: Neural networks for more sophisticated decision-making

📊 Big Data Analytics

Access to vast amounts of market data is revolutionizing forex robot development:

- Alternative Data Sources: Social media sentiment, economic satellite data

- High-Frequency Processing: Real-time analysis of massive datasets

- Predictive Modeling: More accurate forecasting of market movements

- Risk Assessment: Enhanced evaluation of market risks

🌐 Industry Trends

Annual growth in AI-powered forex robots

Expected market size by 2028

of institutional trading now automated

new forex robots launched monthly

🔮 Future Predictions

- Increased Accessibility: More user-friendly interfaces for retail traders

- Cloud-Based Solutions: Reduced need for local installations

- Regulatory Compliance: Built-in adherence to financial regulations

- Social Trading Integration: Copy trading features within EAs

- Cross-Platform Compatibility: EAs working across multiple brokers

- Enhanced Backtesting: More realistic simulation environments

Stay ahead by continuously learning, experimenting with new technologies, and adapting to market changes. The traders who embrace innovation while maintaining solid risk management principles will thrive in the automated trading era.

❓ Frequently Asked Questions

Here are answers to the most common questions about forex robots and automated trading.

🤔 General Questions

A: Forex robots can be profitable when properly selected, configured, and managed. However, profitability depends on market conditions, strategy quality, and risk management. No EA guarantees profits, and all trading involves risk.

Q: How much money do I need to start with forex robots?

A: Minimum recommended starting capital is $500-1,000. This allows for proper position sizing and risk management while providing enough buffer for learning and potential losses.

Q: Do forex robots work 24/7?

A: EAs can trade 24/5 (forex market hours), but require stable internet and power. Using a VPS (Virtual Private Server) ensures uninterrupted operation even when your computer is off.

Q: Can I use multiple forex robots simultaneously?

A: Yes, but be careful about conflicting signals. Use different magic numbers, trade on different currency pairs, and ensure your total risk exposure remains within acceptable limits.

Q: How long should I test a forex robot before going live?

A: Minimum 3-6 months of demo testing is recommended. Longer testing periods (6-12 months) are better for evaluating performance across different market conditions.

⚙️ Technical Questions

A: MT4 has more available EAs and a larger user community, making it ideal for beginners. MT5 offers more advanced features and better performance but has fewer available EAs.

Q: Do I need programming skills to use forex robots?

A: No, most commercial EAs come with user-friendly interfaces and don't require programming knowledge. However, basic understanding helps with configuration and troubleshooting.

Q: What if my internet connection fails while trading?

A: This is why using a VPS is crucial. A VPS provides 24/7 uptime and ensures your EA continues trading even if your local internet fails.

Q: How often should I update my forex robot?

A: Check for updates monthly or when your broker changes requirements. Stay updated with security patches and performance improvements released by the EA developer.

💰 Financial Questions

A: Realistic annual returns range from 10-30% for well-performing EAs. Higher returns often come with higher risk. Be wary of EAs promising unrealistic returns like 100%+ annually.

Q: How much should I pay for a forex robot?

A: Legitimate EAs typically cost $100-$500. Avoid free EAs from unknown sources and extremely expensive EAs that aren't justified by performance claims.

Q: Can forex robots guarantee profits?

A: No legitimate forex robot can guarantee profits. All trading involves risk, and past performance doesn't guarantee future results. Be wary of claims of guaranteed returns.

📚 Conclusion

Forex robots represent a powerful tool for modern traders, offering the potential for consistent, emotion-free trading execution. However, success with automated trading requires proper education, careful selection, and diligent management.

• Forex robots can significantly enhance trading efficiency but require proper setup and monitoring

• Start with demo trading and conservative settings before risking real capital

• Choose EAs based on verified backtesting and transparent performance data

• Implement proper risk management and never risk more than you can afford to lose

• Stay updated with technology trends and market conditions for long-term success

Whether you're a beginner exploring automated trading or an experienced trader looking to optimize your strategy, forex robots offer opportunities to improve your trading performance. Remember that success in forex trading, whether manual or automated, requires continuous learning, discipline, and proper risk management.

Begin with the next article in this series: "MT4 vs MT5 Expert Advisors" to learn about the platform differences and choose the best environment for your automated trading success.

📈 Continue Your Learning:

→ MT4 vs MT5 Expert

Advisors |

→ Best Free Forex EAs |

→ How to Test Forex Robots

No comments