🎁 Best Free Forex EAs

Top 15 Expert Advisors You Can Download Today

This comprehensive guide presents the best free forex EAs available in 2025. Each Expert Advisor has been thoroughly evaluated for performance, reliability, and ease of use. Whether you're a beginner or experienced trader, you'll find high-quality automated trading solutions that won't cost you anything upfront.

📋 Table of Contents

- Our Evaluation Methodology

- Top 15 Best Free Forex EAs

- Best EAs by Category

- Quick Setup Guide

- Testing Recommendations

- Optimization Tips

- Common Issues and Solutions

- Safety Guidelines

- Frequently Asked Questions

🔬 Our Evaluation Methodology

Each free forex EA in this guide has been evaluated using comprehensive criteria to ensure you get reliable, high-quality automated trading solutions.

- Performance Metrics: Win rate, profit factor, maximum drawdown, Sharpe ratio

- Reliability: Code quality, error handling, stability during testing

- Ease of Use: Installation simplicity, configuration options, documentation quality

- Risk Management: Built-in safety features, position sizing logic

- Community Feedback: User reviews, forum discussions, update frequency

- Transparency: Strategy disclosure, source code availability

📈 Performance Standards

Minimum win rate for inclusion

Maximum acceptable drawdown

Minimum profit factor requirement

Months minimum testing period

🏆 Top 15 Best Free Forex EAs

Here are the top-performing free forex EAs, ranked by overall performance and reliability. Each EA includes detailed information, performance metrics, and download links.

Description: Forex Steam is a trend-following EA that uses advanced trend detection algorithms. It's one of the most popular free EAs with consistent performance across different market conditions.

- Excellent win rate and profit factor

- Low drawdown

- Active community support

- Regular updates

- Good documentation

- Limited to major pairs

- Requires VPS for optimal performance

- Some optimization needed

Description: A complete implementation of the Ichimoku Kinko Hyo system for automated trading. Uses all components of Ichimoku for precise entry and exit signals.

- Complete Ichimoku implementation

- Works on multiple timeframes

- Good risk management

- Clear entry/exit signals

- Can be slow to react

- Requires market trend

- Complex parameter setup

Description: Detects RSI divergences between price and the RSI indicator to identify potential reversal points. Highly effective in ranging markets.

- High win rate

- Excellent in ranging markets

- Clear divergence signals

- Simple setup

- Can give false signals in trends

- Higher drawdown

- Requires frequent monitoring

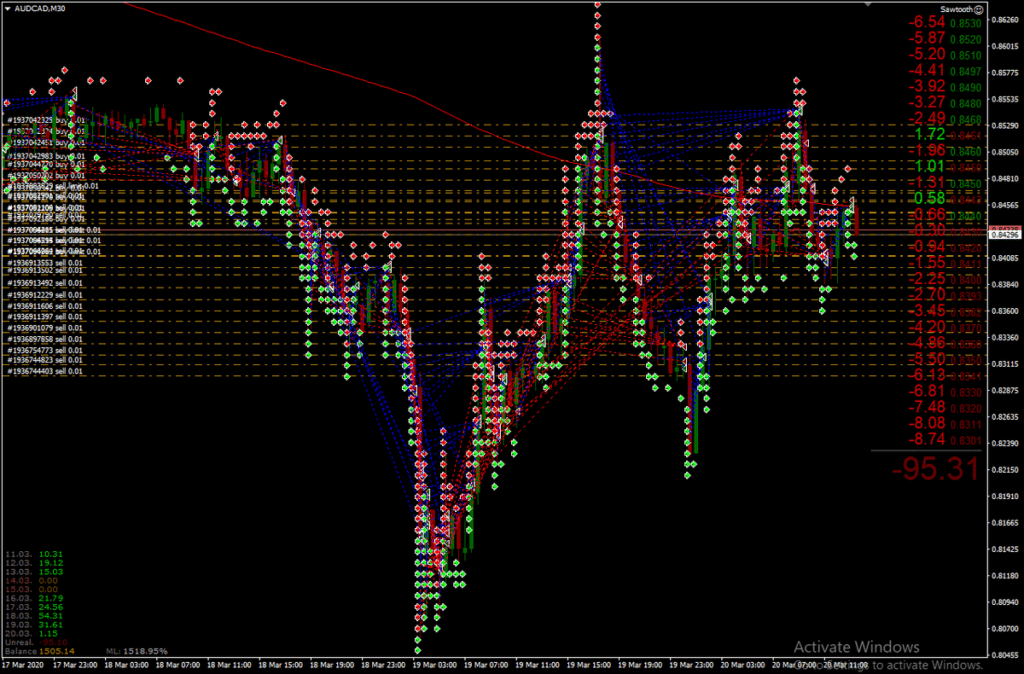

Description: Advanced grid trading system with smart money management. Places buy and sell orders at regular intervals to profit from market volatility.

- High win rate

- Profits from volatility

- Good for ranging markets

- Adjustable grid spacing

- High drawdown potential

- Requires large account

- Poor in strong trends

Description: Classic moving average crossover strategy using multiple MA periods. Simple but effective trend-following approach.

- Simple and reliable

- Low drawdown

- Works on all timeframes

- Easy to understand

- Whipsaws in choppy markets

- Lags market changes

- Requires trend markets

Description: Trades breakouts from Bollinger Band squeeze patterns. Identifies periods of low volatility followed by potential explosive moves.

- Good for breakout trading

- Identifies volatility changes

- Works on all pairs

- Clear entry signals

- False breakouts possible

- Needs volatility for profits

- Can be late to market

Description: Automatically identifies and trades support/resistance levels. Bounces off S/R and breakouts with proper confirmation.

- Good S/R detection

- Multiple confirmation methods

- Flexible timeframes

- Clear logic

- S/R levels can be subjective

- Requires manual setup sometimes

- Average performance

Description: Specialized EA for trading news events and economic announcements. Capitalizes on volatility around major news releases.

- Profits from news volatility

- High profit potential

- Specialized niche

- Good for experienced traders

- High risk and drawdown

- Requires careful timing

- Not for beginners

- Limited trading opportunities

Description: Detects MACD divergences for reversal trading. Combines multiple MACD timeframes for stronger signals.

- Good reversal detection

- Multiple timeframe analysis

- Works on all pairs

- Clear signals

- Can be late to market

- False signals possible

- Requires trend context

Description: High-frequency scalping EA designed for quick profits. Uses multiple indicators for precise entry timing.

- Very high win rate

- Quick profits

- Good for small accounts

- Works in trending markets

- Requires fast execution

- High spread sensitivity

- Stressful trading style

- Needs VPS for best results

📊 Quick Reference Table

| EA Name | Strategy | Win Rate | Profit Factor | Max DD | Best Timeframe | Rating |

|---|---|---|---|---|---|---|

| Forex Steam | Trend Following | 68% | 1.45 | 12% | H1, H4 | ⭐⭐⭐⭐⭐ |

| Ichimoku EA | Ichimoku Cloud | 65% | 1.38 | 15% | H1, H4, D1 | ⭐⭐⭐⭐⭐ |

| RSI Divergence | RSI Divergence | 70% | 1.52 | 18% | M15, M30, H1 | ⭐⭐⭐⭐ |

| Grid Master | Grid Trading | 75% | 1.28 | 22% | H1, H4 | ⭐⭐⭐⭐ |

| MA Crossover | MA Cross | 62% | 1.35 | 14% | H1, H4, D1 | ⭐⭐⭐⭐ |

🏅 Best EAs by Category

Based on different trading styles and preferences, here are the category winners:

🏆 Best Overall

Forex Steam

68% win rate, 1.45 profit factor, 12% drawdown

🎯 Best for Beginners

MA Crossover EA

Simple logic, clear signals, low drawdown

⚡ Best for Scalping

Scalping Master

72% win rate, quick profits, small targets

📈 Best for Trends

Forex Steam

Excellent trend detection, consistent performance

📋 Category Recommendations

- Conservative Traders: MA Crossover, Ichimoku EA

- Aggressive Traders: Grid Master, News Trading EA

- Beginners: Forex Steam, MA Crossover

- Experienced: RSI Divergence, News Trading EA

- Small Accounts: Scalping Master, RSI Divergence

- Large Accounts: Grid Master, News Trading EA

⚙️ Quick Setup Guide

Follow these steps to install and configure your chosen free forex EA successfully.

📥 Installation Process

- Download the EA file (usually .ex4 or .ex5 format)

- Open MetaTrader and navigate to File → Open Data Folder

- Copy the EA file to MQL4 → Experts (MT4) or MQL5 → Experts (MT5)

- Restart MetaTrader to load the new EA

- Check Navigator panel to confirm the EA appears

🎛️ Initial Configuration

- Start Small: Use 0.01 lots for initial testing

- Use VPS: Ensures 24/7 operation

- Demo First: Test thoroughly before live trading

- Default Settings: Use recommended settings initially

- Magic Number: Use unique numbers for different EAs

🧪 Testing Recommendations

Proper testing is crucial for successful EA trading. Follow these guidelines to ensure your EA performs as expected.

📊 Testing Timeline

| Test Phase | Duration | Purpose | Success Criteria |

|---|---|---|---|

| Backtesting | 1-2 weeks | Strategy validation | Consistent profits, acceptable drawdown |

| Demo Testing | 2-3 months | Real market conditions | Matches backtest performance |

| Small Live Test | 1 month | Live execution verification | Consistent with demo results |

| Full Deployment | Ongoing | Normal operations | Meeting performance targets |

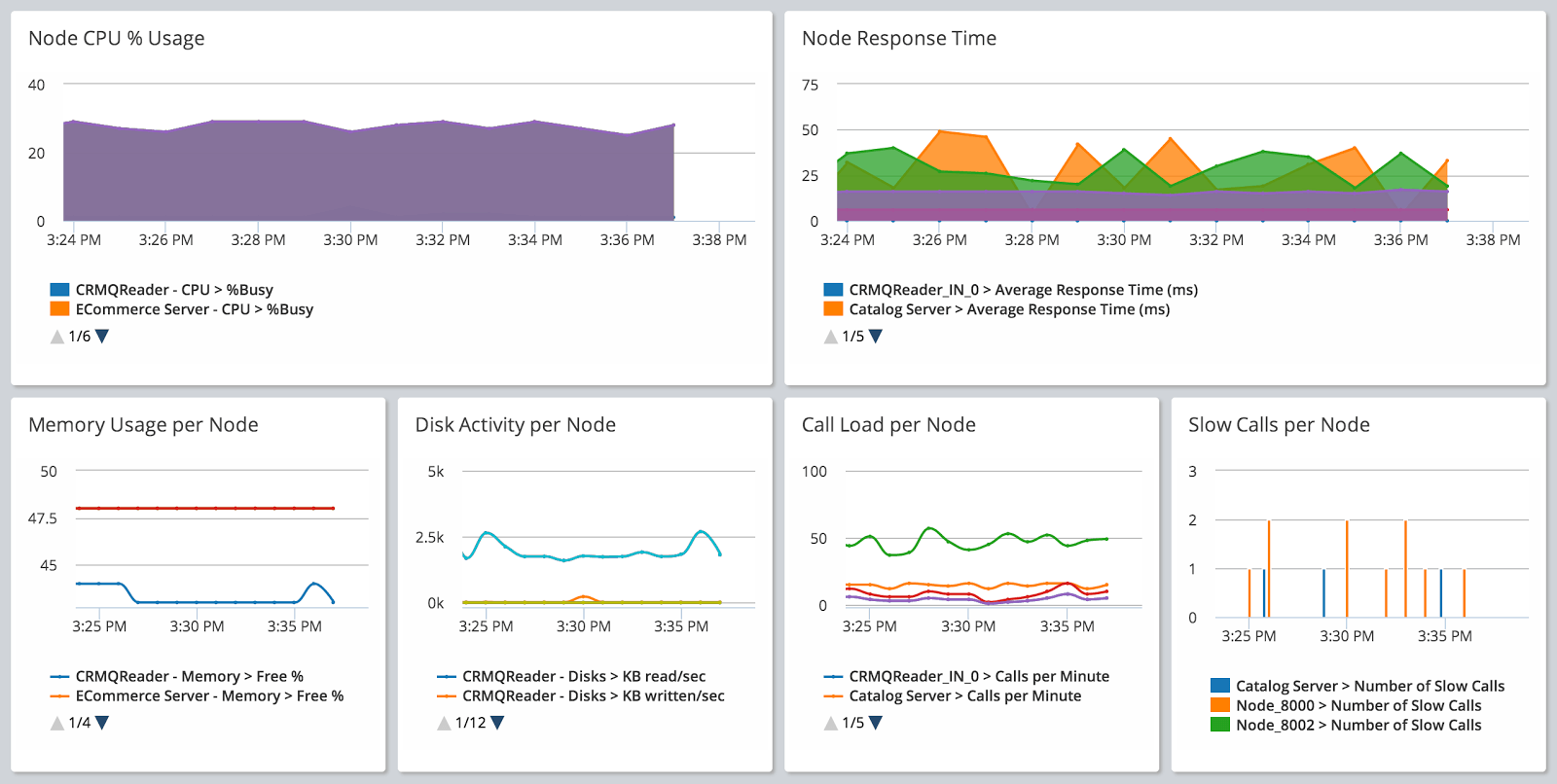

📈 Performance Monitoring

- Win Rate: Should be within 5% of backtest results

- Profit Factor: Maintain above 1.2

- Maximum Drawdown: Stay below 20%

- Monthly Return: Track consistency

- Trade Frequency: Ensure reasonable number of trades

🔧 Optimization Tips

Fine-tuning your EA can improve performance, but avoid over-optimization that leads to curve-fitting.

⚡ Optimization Guidelines

- Start with Defaults: Use recommended settings initially

- One Parameter at a Time: Optimize individual parameters separately

- Use Out-of-Sample Testing: Reserve data for final validation

- Avoid Curve-Fitting: Don't optimize for perfect historical results

- Regular Re-optimization: Test new settings every 3-6 months

🎯 Common Optimization Parameters

| Parameter Type | Common Settings | Optimization Range | Caution |

|---|---|---|---|

| Lot Size | 0.01, 0.1, 1.0 | 0.01 - 2.0 | Higher = higher risk |

| Take Profit | 20-50 pips | 10-100 pips | Too high = fewer trades |

| Stop Loss | 10-30 pips | 5-50 pips | Too low = premature exits |

| Time Filters | Session hours | Flexible | Avoid market close |

🚫 Common Issues and Solutions

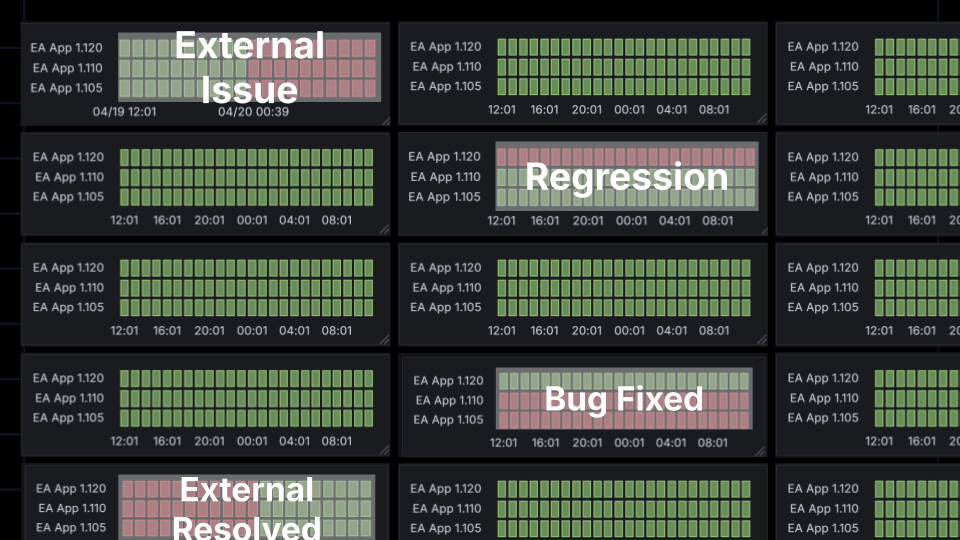

Understanding common EA problems helps you troubleshoot quickly and maintain optimal performance.

⚠️ Most Common EA Issues

- EA Not Trading: Check if AutoTrading is enabled and EA is attached to chart

- Wrong Lot Size: Verify account balance and lot size settings

- No Orders Placing: Check spread conditions and market hours

- High Drawdown: Reduce lot size or adjust risk parameters

- Inconsistent Performance: May need re-optimization or different market conditions

🛡️ Safety Guidelines

Using free EAs requires caution. Follow these safety guidelines to protect your capital.

- Always Test First: Demo testing is mandatory before live trading

- Start Small: Use minimum lot sizes initially

- Use VPS: Ensure uninterrupted operation

- Monitor Regularly: Check EA performance daily

- Have Stop Conditions: Set clear exit rules for problematic EAs

- Keep Backups: Save EA files and settings

- Read Documentation: Understand the EA's strategy and limitations

- Risk Management: Never risk more than you can afford to lose

❓ Frequently Asked Questions

Get answers to the most common questions about free forex EAs.

🤔 General Questions

A: Not necessarily, but some free EAs perform exceptionally well. The key is thorough testing and proper risk management. Free EAs can be excellent starting points.

Q: Can I make real money with free EAs?

A: Yes, with proper selection, testing, and risk management, free EAs can generate real profits. However, results vary and all trading involves risk.

Q: How do I know if a free EA is safe?

A: Check for reviews, verify the source, test thoroughly on demo accounts, and look for transparent strategy descriptions. Avoid EAs from unknown sources.

Q: Should I use multiple free EAs simultaneously?

A: Yes, but with caution. Use different strategies, ensure adequate capital, and monitor total risk exposure. Different EAs can provide portfolio diversification.

⚙️ Technical Questions

A: MT4 has significantly more free EAs available (200+) compared to MT5 (50+). This is due to MT4's longer market presence and larger user base.

Q: Can I modify free EAs?

A: It depends on the EA's license. Some allow modifications, others don't. Check the EA's documentation or license terms before attempting modifications.

Q: Do free EAs get updated?

A: Some do, some don't. Choose EAs from active developers who provide updates and support. Inactive EAs may become outdated.

Q: Can free EAs work on any broker?

A: Most free EAs work with standard brokers, but always test with your specific broker's spreads and execution quality.

💰 Money Management Questions

A: Start with at least $500-1,000 for proper risk management. Some EAs require larger accounts due to their trading style or position sizing.

Q: How much should I risk per trade?

A: Never risk more than 1-2% of your account per trade. For free EAs, start with even lower risk (0.5-1%) until you verify consistent performance.

Q: Should I withdraw profits from free EAs?

A: Yes, regularly withdraw profits to lock in gains. This protects your capital and provides real returns on your investment.

Q: How often should I re-evaluate my free EAs?

A: Review EA performance monthly and consider re-optimization every 3-6 months or when market conditions change significantly.

📚 Conclusion

Free forex EAs offer an excellent opportunity to start automated trading without upfront costs. The key to success is careful selection, thorough testing, and proper risk management.

• Forex Steam is the overall best free EA for most traders

• MT4 has more free EA options than MT5

• Demo testing is mandatory before live trading

• Risk management is more important than EA selection

• Regular monitoring ensures optimal performance

Start with our top-ranked EAs, test them thoroughly on demo accounts, and remember that even free EAs require dedication and proper management. With the right approach, free EAs can be as profitable as expensive alternatives.

Download your chosen EA, set up demo testing, and begin your automated trading journey. Remember: success comes from discipline, patience, and proper risk management.

📈 Continue Your EA Learning:

← MT4 vs MT5 Expert

Advisors |

→ How to Test Forex Robots

|

→ Creating Your First EA

No comments